In September, the U.S. Department of Transportation (DOT) issued a Request for Information (RFI) to seek industry input on Complementary Positioning, Navigation, and Timing (CPNT) technologies.

Earlier this year, the European Commission’s (EC) science and knowledge service, the Joint Research Centre (JRC), issued its report Assessing Alternative Positioning, Navigation, and Timing Technologies for Potential Deployment in the EU. It summarized the assessment of seven Alternative PNT (A-PNT) platforms which occurred during the eight month period between October 2021 and July 2022. It concluded that commercially available mature Alternative-PNT (A-PNT) technologies are already present in the market that can provide positioning and/or timing information separately from Global Navigation Satellite Systems (GNSS). It also concluded that a system of systems approach that incorporates a range of interoperable technologies, supported by standards, remains the lynchpin to resilient PNT. Will any of the technologies reviewed in the JRC Report come out on top in the U.S. as serious contenders for CPNT?

What’s In A Name?

Before comparing the JRC and DOT requirements as a potential indicator of which technologies may prevail in a U.S. contest for the same, the first issue is whether or not the DOT’s CNPT and the EC’s A-PNT even refer to the same thing. Spoiler alert: they kinda don’t.

It’s nuanced. The EC defines A-PNT as “backup solutions,” meaning “technologies providing PNT independently from GNSS.”(1)

A look at the Volpe Report from a couple years ago would lead one to believe the EC and DOT are on exactly the same page. Back then, both US law, DOT policy and research statements lumped together the terms CPNT and “backup GPS capability” or “GPS backup” technologies. Both essentially meant “capabilities to back up and complement the PNT capabilities of the GPS.”(2) (Gotta love definitions that use the same term to define the term in question.) In fact, even the September 2023 DOT CPNT Plan defines CPNT systems as resilient PNT technologies that could offer complementary service in the event of GPS disruption, denial, or

manipulation.(3)

While this sounds like more of the same, the Plan also shows an important evolution of thinking. In describing the tech DOT seeks, it says “CPNT technologies must provide increased capability, not viewed (sic) only a backup to GPS.”(3) Read that again.

It must also, according to the Plan, have a “mature threat posture against capable actors.” And the Federal Government will act as “lead investor/subscriber of services” across key domains: maritime, rail, and surface applications.

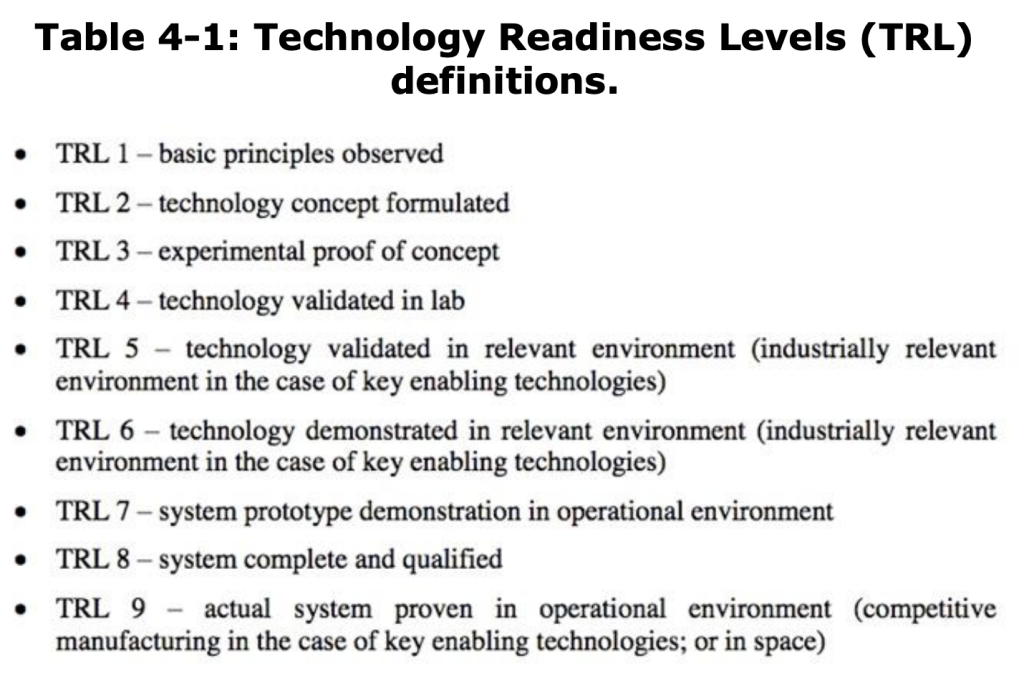

That’s why we see what we see in DOT’s recent RFI. (Previous IG coverage here: https://insidegnss.com/all-jammed-up-dot-urgently-seeks-complementary-pnt/) And there’s more. A glaring difference between A-PNT and CPNT, at least from this initial testing volley, lies in the selection criteria for potential participants. The JRC required a Technology Readiness Level (TRL) greater than 5 for position/navigation services or greater than 6 for timing services. The DOT RFI required a TRL of 8 or beyond. This requirement harkens back to the CPNT plan indicating a need for “mature” technology. A TRL of 8 or 9 indicates something already in use, off-the-shelf if you will, on the commercial market. It underscores the DOT’s current sense of urgency to find it.

A close read of the RFI also shows the DOT seeks interoperable tech. It’s not looking for stand alone, apples-to-oranges systems. It’s looking for an entire CPNT ecoverse to bridge the gap should GPS go Poof!

Yet among all of these differences, the needs driving these different requirements are generally the same here and across the pond.

The Driving Need

Both the U.S. and EC rely heavily on GNSS services for PNT, across a myriad of burgeoning sectors from car-sharing platforms, intelligent logistics solutions, autonomous transit systems (e.g., vehicles, vessels, and aircraft), geolocation-based applications, precision agriculture and more. Perhaps more importantly, vital infrastructures, deemed strategic linchpins for modern societal operations, leverage PNT services, particularly the timing proficiencies. These include telecommunications, energy, finance and a spectrum of transportation modalities (road, maritime and aviation). The need for, and the characteristics of, likely user communities who need A-PNT/CNPT are very similar globally.

With regard to the European front, the JRC Report indicated that an uptick in GNSS jamming and spoofing incidents presents a threat to the GNSS-driven EUR 2 trillion socio-economic boom across Europe (the EU27, UK, Norway and Switzerland) projected by 2027. In terms of dollars and sense, the U.S. and United Kingdom (U.K.) threat assessments have posited that the economic detriment of GNSS unavailability could approximate a EUR 1 billion daily.

These threat estimates do not include GPS jamming incidents in or around the eight countries still pending EU membership, most notably Ukraine.(4) Spillover GPS jamming effects from Russian electronic warfare (EW) has already adversely impacted commercial airlines and shipping in both Bulgaria and Romania. Some have posited that this war-related EW activity has significant potential to destabilize the entire Black Sea region.(5)

In response to these ever-increasing vulnerabilities, to bolster the resilience and ensure the continuity of critical operations, the U.S., the European Union (EU) and U.K., among others, look to find and implement robust and resilient PNT services, whether as alternatives, backups to or completely autonomous-from-but-interoperable-with conventional GNSS services on their own home fronts.

So, does the JRC Report provide any relevant insights for a DOT CPNT solution? Answer: a few.

Some Clues

While the EC characterizes its test results as a “qualitative assessment,” rather than a benchmark, some things in the JRC Report nevertheless can provide a bit of insight into some of the technologies the DOT may be eyeballing for holistic U.S. CPNT system-of-systems solutions. (Previous IG coverage provides a detailed explanation as to how the JRC demos were conducted: https://insidegnss.com/backing-up-gnss/).

Let’s focus on the capabilities to knock out a few contenders right away, at least in terms of independent tech that can act as more than just a back up to GPS, meaning one that could go it alone (while also working well with others). The JRC demonstrations involved seven selected providers. OPNT, 7 Solutions SL, SCPTime and GMV focused on timing services only. That makes them interesting but not the final answer. Satelles, Locata and NextNav successfully demonstrated both positioning and timing. That puts them in the ring.

Next, let’s use the TRL level to show that at least one contender remains down for the count and show our Top 3 are still in the fight. As noted, the EC only required a TRL greater than 5 for position/navigation services or greater than 6 for timing services; DOT seeks a TRL of 8 or higher.

Based on the TRL alone, the DOT RFI’s more stringent criteria GMV Aerospace and Defence SAU is K.O.’d. Although the key technologies used in the company’s WANtime solution all have a high TRL (minimum 6), which qualifies it for the JRC project, each technology individually has a different TRL. Combined their average TRL levels put GMV Aero’s tech at an estimated overall TRL of 7. (6) For example, its atomic clocks, clock modeling and steering and time transfer technology, based in GNSS or TWSTFT and used in the operational generation of Galileo System Time (GST) in the Galileo Precise Timing Facilities (PTFs), can all be considered TRL 9. The company gave its White Rabbit (WR) a TRL of 8, as it noted that “especially long-range WR, poses quite a few challenges and requires careful network engineering.” The application of DTM, packet-exchange network technology, to timing applications is still under development and comes in at TRL 7. Higher-precision network time protocol (NTP) is a relatively new, experimental area and can be considered TRL 6.

On the other hand, Satelle’s LEO satellites for satellite timing and location (7), NextNav’s TerraPoiNT ground-based solution that leverages existing cellular LTE/5G signals and dedicated Signal Sensors and/or TerraPoiNT transmitters (8) are both reported as TRL 9.

While the TRL level for Locata’s LocataNets, a system of terrestrial beacons to provide PNT signals to dedicated receivers in a localized area, were not readily accessible, its commercial deployment in different environments like open-cut mines and harbors, combined with its testing by significant entities like the U.S. Air Force at the White Sands Missile Range, suggests its mature stage in the TRL spectrum, possibly at or near TRL 9. This pseudolite alternative uses multiple, geographically dispersed, terrestrial transmitters to provide passive or pseudo ranging signals that can be used to accurately calculate position. Notably, the EU ranks pseudolites in general at a TRL of 9. (9)

Assuming Satelles, Locata and NextNav have thrown their hats in the ring for DOT’s RFI, and that they can meet DOT’s security and interoperability requirements, their tech illustrates a sea change from reliance on middle earth orbit (MEO) satellites for PNT. Satelles’ solution orbits in LEO, while Locata and NextNav are both terrestrial based. The times (no pun) they may be a changin’.

Next Steps

So, where do we go from here? In Europe, even though the EC just put out its European Radio Navigation Plan 2023 in June, it already has plans in the works to update it. Europe also intends to evolve Galileo and EGNOS and issue new regulations. What exactly it intends to do with the JRC 7, if you will, remains a mystery.

But likely at least 3 of those 7 companies may have a real shot here in the U.S. The DOT’s recent RFI. That’s the first step. The next would be the issuance of a request for proposal (RFP) to actually make that testing a reality. Applying the tech to real world use cases would be the goal. To do that, as noted way back in Volpe’s 2021 report, and now the JRC report, also requires the creation of standards.

For now, who’s really positioned to navigate DOT’s process, and what’s the timing? We may have teased out a few clues here, but, in the end, only time will tell.

References:

- https://joint-research-centre.ec.europa.eu/scientific-activities-z/alternative-pnt_en#:~:text=To%20address%20this%20threat%2C%20it,or%20A%2DPNT%20for%20short.

- https://www.transportation.gov/sites/dot.gov/files/2021-01/FY%2718%20NDAA%20Section%201606%20DOT%20Report%20to%20Congress_Combinedv2_January%202021.pdf

- https://www.transportation.gov/sites/dot.gov/files/2023-09/DOT%20Complementary%20PNT%20Action%20Plan_Final.pdf

- https://european-union.europa.eu/principles-countries-history/joining-eu_en

- https://www.rferl.org/a/russia-gps-jamming-black-sea-romania-bulgaria-ukraine/32655397.html

- https://joint-research-centre.ec.europa.eu/system/files/2023-02/Report_GMV.pdf

- https://satelles.com/wp-content/uploads/pdf/Satelles-STL-Data-Sheet.pdf

- https://nextnav.com/gps-alternative/

- https://data.consilium.europa.eu/doc/document/ST-10259-2023-INIT/en/pdf

- https://www.minalogic.com/en/member-news/scptime-selected-by-the-european-commission/

- https://joint-research-centre.ec.europa.eu/system/files/2023-02/Report_7Sol.pdf