Thwarted thus far in efforts to convert satellite spectrum into a terrestrial service, LightSquared Inc. and 19 affiliates have filed for bankruptcy. But the would-be wireless broadband provider said it had not abandoned efforts to build out a nationwide network of transmitters that extensive tests have shown would interfere with GPS receivers.

Thwarted thus far in efforts to convert satellite spectrum into a terrestrial service, LightSquared Inc. and 19 affiliates have filed for bankruptcy. But the would-be wireless broadband provider said it had not abandoned efforts to build out a nationwide network of transmitters that extensive tests have shown would interfere with GPS receivers.

Today (May 15, 2012), the U.S. Bankruptcy Court, Southern District of New York, ordered the consolidation of the May 14 filings by LightSquared under Chapter 11 of the federal bankruptcy law.

Among the largest unsecured creditors that signed on to help LightSquared build its system were Boeing Satellite Systems Inc. based in El Segundo, California, and France’s Alcatel-Lucent. They had outstanding claims of nearly $7.5 million and more than $7.3 million, respectively.

According to the company’s filing with the bankruptcy court, its largest creditors’ claims are at least partly secured by the LightSquared’s assets. One is a term loan obtained by LightSquared Inc. in July 2011 on which $322,333,494 is now owing and due by the end of this year to lenders represented by U.S. Bank NA as agent. The other is a credit facility that LightSquared LP obtained in October 2010 with UBS AG and Wilmington Trust FSB serving as agents for the lenders.

More than $1.7 billion is now owing on that account.

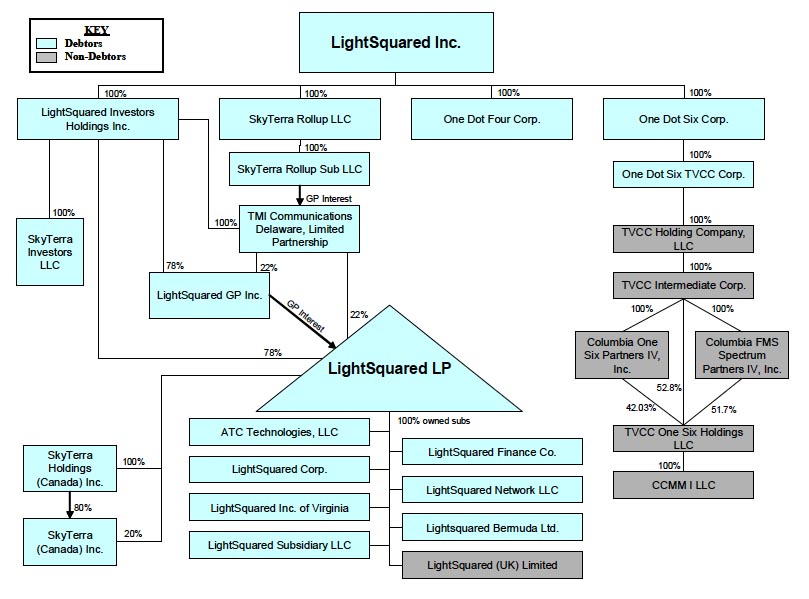

The accompanying schematic filed with the bankruptcy court shows the complex linkages among LightSquared-affiliated companies.

Backed by the Harbinger Capital hedge fund headed by Phil Falcone, LightSquared’s fortunes reversed course earlier this year when the Federal Communications Commission (FCC) proposed to vacate its conditional waiver order permitting rollout of LightSquared’s terrestrial network and "suspend indefinitely" LightSquared’s ancillary terrestrial component (ATC) authority.

That move after months of laboratory and field tests indicated that the powerful LightSquared transmitters would cause widespread problems for GPS receivers in an adjacent band.

Nonetheless, after spending 7 pages of its 85-page filing recounting its version of the GPS interference controversy, the company stated, “LightSquared thus remains committed to finding a resolution with the FCC and the GPS industry to resolve all remaining concerns.”

In a statement issued on Monday, Marc Montagner, interim co-chief operating officer and chief financial officer of LightSquared, said, “The filing was necessary to preserve the value of our business and to ensure continued operations. The voluntary Chapter 11 filing is intended to give LightSquared sufficient breathing room to continue working through the regulatory process that will allow us to build our 4G wireless network. All of our efforts are focused on concluding this process in an efficient and successful manner.”

The company said it intends “to work with all key constituents to conduct an orderly restructuring process to maximize its asset value and to exit Chapter 11 in the quickest and most efficient manner possible.”

LightSquared said that it expects that its current management team will continue to lead the company throughout this process.