The world’s four GNSS programs aren’t exactly a classical quartet, weaving Mozart stanzas in disciplined execution.

They are more like a new jazz combo, riffing off one another while still trying to get in the groove.

Whatever image the metaphor evokes, if the world’s GNSS programs want to hit that high note of interoperability (to which they all say they aspire), the operators of GPS, GLONASS, BeiDou, and Galileo must learn to harmonize better.

Today 73 satellites transmit a half-dozen compatible signals as GNSS continues to make inroads into the daily life of the planet’s citizens. One shorthand data point is that more than one billion GNSS receivers are in operation around the globe, but by now no one is really keeping count.

Where is that number going?

Well, GNSS fortunes at the consumer level have been increasingly linked in the past few years to the growth in mobile devices. And, according to the 2012 edition of the publication produced by a former Nokia executive, Tomi Ahonen Phone Book, that market segment now adds up to an estimated 6.7 billion mobile devices, including mobile phones and tablets.

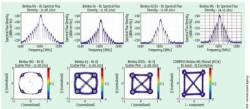

This figure from the German Space Agency (DLR) reveals the improvement in China’s BeiDou signal quality. The blue curves in the top panels show the signal spectra of the various types of BeiDou satellites: The first M1 satellite (launched in 2007) compared to a geostationary satellite G3 (launched June 2010), geosynchronous satellite IGSO-1 (launched July 2010), and the new M5 satellite. The scatterplots at the bottom of the figure reveal the improvement in the signals as portrayed in I/Q constellation diagrams.

So, the middle-term growth curve for GNSS is probably somewhere between 1 and 7 billion — probably a conservative figure, if we assume that many people will eventually acquire multiple mobile devices, with GNSS going along for the ride. If the experience in recent years gives any indication, commercial, professional, and scientific GNSS markets will have a similar, though less steep, trajectory with lower unit volumes.

But it’s not all about GNSS. It’s not just about satellites and signals and user equipment. In fact, it’s not even just about positioning, navigation, and timing (PNT) technologies and applications.

The GNSS storyline is becoming ever more about global trade, markets, competition, standards and certification, intellectual property and patent protection, partnerships, engineering, brand-building, national budgets, franchises, consumer confidence, and social behavior.

In short, the musical score of the GNSS quartet is really about business and economies and politics.

A Break in the Action

These subjects will probably get more attention in the coming year as additions to the cumulative GNSS resource seem likely to take a breather.

Confirmed GNSS satellite launches in 2013 total between five and seven: two GPS Block IIFs (tentatively May and November), two Galileo spacecraft on a Russian Soyuz rocket (with another dual launch possible), and one GLONASS-K.

This would represent a dropoff in the pace of recent years, which saw 12 GNSS space vehicles (SVs) go up in 2010 and again in 2011 and then 9 last year.

The BeiDou program, which placed 14 satellites in orbit during the past three years, will not launch any more spacecraft this year, according to Ran Chengqi, director of the China Satellite Navigation Office.

Europe has an aggressive launch schedule for Galileo, but must ensure that it has worked out software problems on the new fully operational capability (FOC) spacecraft being built by OHB-System. Russia and the United States have full constellations; so, they are essentially in the satellite replacement/sustainment mode with modernization programs rolling along in the background.

Circumstances may change and more or fewer SVs may find their way into space in 2013, but a critical mass of GNSS space and ground infrastructure is already in place. This means that the four programs have an opportunity to catch up with their separate and collective achievements and begin to match these in the realms of policy, operations, and market and product development.

So, let’s take a look at just three of those key areas: product and market development and the siren call of GNSS interoperability.

Product Development

The December 27 publication of BeiDou’s first interface control document (ICD) means that product designers, system integrators, and receiver manufacturers now have the technical specifications needed to design user equipment exploiting any combination of the four GNSS systems.

The ICD for the BeiDou civil B1 signal has stimulated a new burst of multi-GNSS receiver development, with manufacturers such as NovAtel and Septentrio announcing BeiDou upgrades to existing product lines. Many more will join in.

GLONASS/GPS combinations are already common in high-precision, high-cost commercial and professional equipment and, in the last year or so, in a growing number of consumer products. Mass market–oriented manufacturers, including STMicroelectronics and u-blox, have also demonstrated interest in bringing BeiDou technology quickly to market.

Many more manufacturers are standing by to implement Galileo capabilities on receivers when that system finally has a sufficient signal resource to be useful and interesting.

Regional players, such as Japan’s Quasi-Zenith Satellite System (QZSS) and the Indian Regional Navigation Satellite System (IRNSS), have already had their signal and constellation parameters incorporated into GNSS simulator products; so, they are ready for speedy adoption as they mature.

Driving the addition of GNSS systems to consumer products is the need to improve positioning in signal-challenged environments such as urban canyons and to provide new feature sets among competing brands.

Silicon and software are cheap; so, similar signals clustered around the 1575 MHz band — including the next-generation binary offset carrier (BOC) and multiplexed BOC signals — will be readily accepted by receiver manufacturers. Adding antennas, RF integrated circuits (RFICs), low noise amplifiers (LNAs), and so forth to accommodate additional frequencies will be a harder sell.

Signals in relatively distant bands, such as L5/E5, may remain limited to professional and scientific equipment used in applications such as surveying, atmospheric sensing for weather forecasting, military and security operations, and commercial aviation.

Market Development

Only Europe has a formal, ongoing market development initiative — through the European GNSS Agency (GSA) — for its satellite navigation system. Russia and China, however, have ramped up public relations campaigns through their respective state-influenced news media with similar goals of raising awareness and proclaiming the advantages of their systems.

Even the United States, the original GNSS provider, has modified its “if we build it, they will come,” philosophy and undertaken some strategic marketing over the years. These have included a series of United Nations–cosponsored workshops on GNSS, originally launched in 2001 for GPS and broadened to include other systems over the years.

Meanwhile, the National Coordination Office for U.S. Space-Based PNT has built and maintains a richly populated website at gps.gov that highlights GPS applications, policy, and program developments with multimedia and other online resources.

GNSS operators also have supported their own systems with specific application and product developments, including military, with grants to academic and small business organizations and government agencies. Bilateral projects have similar objectives, such as China’s BeiDou/GNSS Application Demonstration & Experience Campaign (BADEC) and a series of Russian agreements with India’s government and industry to promote use of GLONASS there.

More ambitious infrastructure projects, such as the Wide Area Augmentation System and Nationwide Differential GPS System in the United States, also stimulate market growth. So do pledges to multinational organizations, such as the International Civil Aviation (ICAO) and International Maritime Organization (IMO), to make GNSS systems available for civil use for many years into the future.

Sometimes more overt forms of shaping domestic markets arise. Both Russia and China have announced plans to require commercial transportation operators in their countries to use their respective national GNSS systems.

Russia has also drawn criticism for its efforts to impose tariffs on imports of navigation devices that don’t incorporate GLONASS capability, and Europe once proposed fees on receivers that would have taxed GPS as well as Galileo.

Russia’s recent announcement to require civil aircraft operating in its domestic airspace to carry GLONASS equipment has caused a controversy still under way at ICAO and among aircraft manufacturers.

China has yet to reveal any regulatory plans that would affect foreign companies entering its domestic market with BeiDou-capable products, although the nation’s Certification and Accreditation Administration (CNCA) says it will establish “an authoritative testing and certification system” for BeiDou equipment by 2015.

In short, everybody is trying to find the sweet spot between open trade and protectionism, between supporting domestic manufacturers and accessing foreign markets, meanwhile running the gauntlet of regulatory filters and competitive advantages that fill the world of commerce. Amid all this positioning of individual systems, GNSS operators still must meet the increasingly clear expectation of users for transparent, synergistic, seamless, ubiquitous solutions.

Interoperability

The lead organization promoting multilateral efforts among system operators, the International Committee on GNSS (ICG), grew out of an initiative by the United Nations Committee on the Peaceful Uses of Outer Space.

The ICG’s primary objectives are to encourage compatibility — that is, avoiding harmful interference among systems — and interoperability, using GNSS services together to provide better capabilities than can be achieved by individual systems alone. In fact, the first of four ICG subgroups — Working Group A — specifically addresses compatibility and interoperability issues.

Ultimately, overseeing RF compatibility falls under the responsibility of the Radiocommunication Bureau of the International Telecommunications Union (ITU), another UN-affiliated organization. So, the ICG’s real contribution has come in the area of interoperability.

Formally established in 2005, the ICG provides an invaluable forum for multilateral discourse — a venue where GNSS system operators can work out terms of reference, introduce new cooperative ventures, and try to agree on common goals toward which to work.

A number of other efforts are under way that could eventually cohere into — or at least contribute to — a more comprehensive infrastructure to support interoperability.

The 17-member Multi-GNSS Asia (MGA) is organizing a demonstration campaign to take advantage of the rich GNSS signal resources in the Asia-Pacific region.

And, last November, China’s BeiDou office issued a call for participation in an international GNSS Monitoring and Assessment System (iGMAS), first proposed at the ICG-6 meeting in Japan in 2011.

The iGMAS would do the following: equip multi-GNSS reference stations with BeiDou/GPS/GLONASS/Galileo-capable receivers, set up new tracking stations jointly for GNSS monitoring and assessment, perform joint experiments addressing technical issues of GNSS monitoring and assessment, define and formulate jointly the GNSS monitoring parameters covering GNSS constellation status, navigation signals, navigation messages, and service performance, and develop and share products jointly.

No musical group is conducted by consensus, however. Indeed, like barbershop quartets, the GNSS programs may have to harmonize by taking their cues from one another. So, bilateral negotiations and agreements will continue in parallel with the multilateral efforts.

Receiver versus System Solutions. Many of the differences among GNSS signals can be reconciled within the receivers to produce a melded position/velocity/time (PVT) solution. But the greater and more numerous the corrections needed, the greater the computational overhead on the device itself, as well as adverse effects on performance, size, weight, power, and cost.

Ideally, the various GNSS systems would converge on common standards. Optimizing the alignment of signals and frequencies, time and geodetic coordinate systems, however, are long-term projects — although the sooner progress is made on them, the sooner they become a present reality.

Another approach would actually create an common, active monitoring system with direct participation of all the GNSS providers — also a challenging prospect.

A shorter path could involve putting data into spare frames of the various GNSS services’ navigation messages to correct offsets between their geodetic and time frames and those of other systems. A couple of years ago, GPS godfather Brad Parkinson proposed what he called a Cross-Augmentation Reference System (CARS) in which each GNSS SV would broadcast corrections — similar to those transmitted by the Wide Area Augmentation System (WAAS) — to allow that satellite to be seamlessly operated as a part of any other constellation.

The plan would avoid the issue of which time or which geodetic system to use and enable GNSS providers to retain some control over use of their own system, Parkinson said, characterizing such an approach as “interchangeability.”

But even this would require an arduous and lengthy process of bilateral and multilateral negotiations to coordinate changes in basic GNSS navigation messages.

Another approach, advocated by Lu Xiaochun of the Chinese Academy of Sciences National Time Service Center, would add such data to other space-based or terrestrial systems, such as the Internet, the Wide Area Augmentation System (WAAS), the European Geostationary Navigation Overlay Service (EGNOS), or mobile communication services.

First, however, the individual programs have to look to their own needs and circumstances — to ensure that their systems are robust, their financing secure, and their technologies forward-looking and future-proofed.

So, let’s take a look at those individual GNSS programs.

GPS

If nothing else, in the year ahead U.S. leaders need to avoid shooting the world’s pioneer GNSS system in the foot, scoring an own-goal against itself, snatching defeat from the jaws of victory.

To use another sports cliché, “It’s GPS’s game to lose.”

And the greatest threat arises not from technical features or comparative advantage, nor operations management, planning, or oversight, but rather from a simple lack of financial resources.

The GPS program continues to be a victim of its own success, creating a false impression that its needs are not urgent. The system has an overpopulated constellation: 35 SVs of which 30 are operational and the others, spares. Another 9 Block IIF SVs are built or nearing completion, sustaining a “baseline constellation” of 24+3.

The system has outperformed its technical goals and suffered little more than occasional hiccups in what the Air Force likes to call the “Gold Standard” of space-based PNT.

Nonetheless, the GPS community opened 2013 with a long list of policy problems for which it must largely depend on politicians in Washington to solve — politicians with their own agendas and problems and an apparently limited sense of urgency.

Topping that list is money — specifically how much money will be available to run the military’s GPS program and the GPS-related civil activities led by the Department of Transportation (DoT).

In regard to GPS’s financial situation, the fallout from partisan squabbling over debt reduction and tax reform in recent years is taking its toll.

With compromise looking remote, the Pentagon is now taking steps to curtail spending in order to weather the storm. GPS modernization, including underfunded civil requirements, will likely be slowed. Conceivably the robustness of the current constellation could be diminished if the stalwart, but elderly, early-generation satellites cannot be replaced as fast as they fail.

The GPS III satellite program may be particularly at risk. Under Congress’s “sequestration” principle, unobligated funds from prior years are likely to be swept up and redirected. Inside GNSS has been told that fiscal year 2012 money for long-lead items for GPS III space vehicles 5 and 6 may yet be withheld.

Budget cuts would also make it harder to deal with unexpected developments such as LightSquared’s recent proposal to build a broadband network that had the potential to debilitate GPS receivers. The effects on GPS of the firm’s plans to recast its assigned frequencies for terrestrial use was not clear at first and money had to be found for extensive tests.

More money had to be found last year for travel and legal and technical research to investigate a dispute over GNSS intellectual property. The British military establishment attempted to enforce patents it had quietly filed on the signal structure for the new L1C signal jointly developed by the United States and the European Union. Although the problem appears to have gone away as the result of a recent UK/U.S. agreement (see the news article here), a successful patent claim could have raised the cost of satellite navigation receivers for every user worldwide.

Meanwhile work has begun on technical solutions to limit interference. So far, this consists of possibly creating standards for GPS receivers and/or predefined interference limits for users of frequencies near the GPS spectrum bands.

Another unknown arises from the change in leadership at the National Coordination Office (NCO) for Space-Based PNT. Anthony (Tony) Russo, who has served as NCO director for the past three years and played a crucial role in dealing with the LightSquared and patent issues, has accepted a new position at NASA.

His successor, Jan Brecht-Clark, recently completed a 19-month assignment as the transportation counselor with the U.S. embassy in Kabul, Afghanistan. She previously held the position of associate administrator for research, development, and technology at the U.S. DoT Research and Innovative Technology Administration (RITA).

GLONASS

Russia is in the middle of resetting its GNSS modernization process as political leaders try to sort out broader problems with the nation’s space operations. The past year revealed problems with shoddy manufacturing, poor program management, corruption, and political maneuvering.

That appears to have contributed to a lull in GLONASS space segment developments. Although the program has plans to expand to a 30-spacecraft constellation, no satellites were launched last year, and only one GLONASS-K launch has been scheduled for February this year.

Russia’s space program calls for building only four SVs this year, although they already have four in storage on the ground: three GLONASS-Ms and one GLONASS-K. At the Aviation and Cosmonautics conference in Moscow last November, Grigory Stupak, deputy designer for GLONASS, said that additional launches in 2013 “will be determined by operational necessity.”

Over the longer term, Russia will build and launch 13 GLONASS-M and 22 GLONASS–K satellites between now and 2020, according to an outline of the nation’s space program published by the Federal Space Agency (Roscosmos)

The program has a stated goal of providing 1.4-meter positioning accuracy by 2015 and 0.6-meter accuracy in 2020. Currently, the document reported, the system provides positioning accuracy with a standard deviation of 5.6 meters, compared to 35–50 meters in 2006.

Meanwhile, Russia is building out other aspects of GLONASS, including the System of Differential Correction and Monitoring (SDCM), a code division multiple access (CDMA) signal design similar to other GNSS systems, and user equipment policies.

In a presentation at the ICG-7 conference held last November in Beijing, China, Stupak outlined the development activities for the SDCM, which will provide integrity messages and improve positioning accuracy while also contributing to the monitoring of the GLONASS constellation.

Russia has deployed 24 SDCM reference stations thus far (19 in Russia) and plans to add another two sites in Russia and 18 at sites around the world.

Overcoming Setbacks. GLONASS has suffered from a more general malaise affecting the Russian space program. In the last few years, a series of launch failures of usually reliable Russian rockets — including the loss of three GLONASS-M satellites in December 2010 — has plagued the Russians.

The satellite loss prompted then-President Dmitry Medvedev to fire the first deputy general designer of the S.P. Korolev Rocket and Space Corporation, the deputy head of the Federal Space Agency (Roscosmos), and, finally, the forced retirement of Roscosmos chief Anatoly Perminov.

Problems continued through 2011, including losses of a Progress M-12M space freighter, an Express AM-4 telecom satellite, and the Phobos-Grunt Martian lunar mission.

Nonetheless, the GLONASS program had four successful launches in 2011 — five Ms and the first next-generation GLONASS-K, restoring the full orbital constellation of 24 GLONASS SVs by October and allowing the Russian government to proclaim full global availability shortly thereafter.

GLONASS controllers appear to be doing well maintaining a full constellation, with the GLONASS-M generation living up to its billing as a longer-lived spacecraft.

The nation’s launch program remains troubled, though. Last August, a Proton heavy-lift launcher failed to place two telecommunications satellites into the correct orbit. In December, it failed again with another telecom satellite. Defects detected in the Fregat upper stage of a Soyuz-2 rocket delayed the planned launch of the second GLONASS-K from the Plesetsk Space Center in December.

In a controversy that appears to be separate from the rocket problems, the GLONASS program lost its chief designer, Yuri Urlichich. In November, the Russian military-industrial commission headed by Deputy Prime Minister Dmitry Rogozin dismissed Urlichich from his position. He later resigned as director general of JSC Russian Space Systems, which contributes to the operation of a number of the nation’s leading space programs in addition to GLONASS.

Galileo

For much of the past two decades, Europe’s GNSS program has suffered from intermittent spells of arrested development — moving ahead in fits and starts occasioned by political forces at the European and member-state level.

But 2013 could be the year that the region puts paid to its Galileo project. The Galileo program is determined to never again have to announce a delay, setback, or programming change. With first operational services pledged for 2014 — for the Open Service (Open), Public Regulated Service (PRS) and Search and Rescue (SAR) and a demonstrator for the Commercial Service (CS) — 2013 is sure to be a hectic year indeed.

Europe’s GNSS leaders now project Full Operational Capability (FOC) of the four services with a 30-satellite constellation by 2020 — a full 12 years past the program’s original schedule.

But first things first. The European GNSS Regulation will underpin the whole show by assigning responsibilities to the main managing entities — the European Commission (EC), the European Space Agency (ESA) and the GSA. And the legislation is still awaiting the necessary approval of the EU Parliament and the European Council.

According to the current draft, which would take effect in 2014, the GSA will be responsible for Galileo and EGNOS exploitation, including program management, marketing of services, and security procedures. ESA will be responsible for design and procurement during the deployment phase, and for technical support and future technical development. And the EC will bear overall responsibility, managing funds, delegating tasks, and monitoring the program.

The sticking point now is thought to be how to deal with R&D activities. Some EU-funded projects are more technical and systems-related, which would argue for ESA control, while others are more apps- or services-related, better overseen by the GSA.

Funding is another critical issue linked to the regulation. According to the Commission’s calculations, about €7.9 billion will be necessary to complete the Galileo deployment phase and finance the exploitation phase from 2014 to 2020. Some indications suggest that it could shrink — to as little as €6.3 billion.

Officials close to the Galileo program, however, say they have no anxiety about obtaining a sufficient budget, there being a very strong sense of confidence about high-level commitment to the program. They expect approval of the EU GNSS Regulation in “early 2013” with budget issues resolved “soon.”

The Commission has set a challenging target of 18 fully operational SVs in orbit by 2014 to allow for delivery of initial services. The first of two launches in 2013 had been planned for this spring, with a second launch later in the year. Apparently, the 2013 schedule has been “flexed,” and both launches are to take place in the fall. The Commission says the launch dates have always been flexible, so moving both 2013 launches to the fall is not, strictly speaking, a “delay.”

Initial services in 2014 are to include a demonstration of the secure, encrypted Galileo signal, the PRS, which will allow developers to feel it out and start thinking about new receiver designs. But before that happens, the issue of the infamous BeiDou signal overlap on Galileo’s PRS will have to be resolved.

In 2009, China announced plans to transmit a BeiDou signal on the wavelength that Europe wants to use for PRS, a situation that would complicate any attempt of European military or security forces to jam non-PRS signals in a theater of operations.

If China goes ahead with this plan, the PRS will pretty much be rendered useless for military purposes, unless China first gives permission.

Backstage chatter suggests that regular talks continue between the European Commission and Chinese GNSS authorities, involving the EC’s head of space activities Paul Weissenberg at DG Enterprise and Industry.

Another long-promised Galileo service that has recently come under scrutiny is the Commercial Service. Meant to provide an “added value” with respect to the Galileo Open Service and other GNSS signals, it essentially comprises two guaranteed and encrypted signals, allowing for a higher data throughput and improved accuracy.

Program managers will need to distinguish CS from the PRS that is also encrypted, but intended for military, public security, and emergency services applications and markets. A final decision on the CS implementation concept is expected “at the beginning of 2013.” Insiders say the outlook is “positive.”

BeiDou

China’s GNSS program was declared operational for service over China and the adjacent Asia/Pacific region at the end of last year and now appears ready to take a break and see what it has achieved thus far.

Having launched 16 BeiDou-2 satellites since 2007 — 14 of them during the past three years — the BeiDou program appears ready to spend the coming year smoothing out its system operation, supporting development of user equipment and applications, and encouraging acceptance of BeiDou by other nations now that its first ICD is generally available.

The propitious timing of release of the BeiDou ICD and the announcement of the system’s availability in the Asia/Pacific region underlines its significance to the nation. These achievements coincided with China’s hosting of the seventh ICG general meeting (ICG-7) in Beijing and with a decadal transition in the nation’s top political leadership.

At the press conference announcing the program milestones, China satnav director Ran said that around 40 more satellites are expected to be launched before the full system is available globally — but none in 2013.

The current constellation includes five geosynchronous (GEO) satellites, five inclined geosynchronous orbit (IGSO) satellites, and four middle-Earth-orbiting (MEO) satellites. China reportedly plans to spend more than 40 billion yuan (US$6.43 billion) to complete the BeiDou system.

China hopes to see BeiDou penetrate its domestic market, 95 percent of which reportedly depended on GPS services in 2011. In the press conference, Ran said he hoped BeiDou would gain 15 to 20 percent of market share by 2015, and ultimately 70 to 80 percent.

According to Xinhua news agency reports, Ran said Beidou’s general functionality and performance within China was “comparable” to the GPS system, with stand-alone positioning accuracy of 10 meters, velocity accuracy of 0.2 meters per second, and one-way timing accuracy of 50 nanoseconds.

Independent analyses of BeiDou operation have confirmed the improving quality of the system. The satellite clocks appear to be producing a stable and accurate timing capability, and the signal quality is very good, according to western GNSS experts.

The accompanying figures (see inset, above right) from a paper presented by German Space Agency (DLR) researchers at the Navitec 2012 conference in December show a steady progression in the BeiDou B1 signal. In the upper graphs presenting the signal spectra of the received BeiDou signals, slight differences appear in the shape caused by different filters used by the satellite families, according to the authors, but in general the spectra are “very symmetrical and clean.”

In the lower graphs, presenting the I/Q constellation diagrams, the authors point out an obvious improvement of the modulation quality over time and generations, especially of the latest middle Earth orbiting M5 satellite compared to the first M1 satellite. “The IGSO-1 and the M5 are more or less nearly perfect,” they wrote.

As BeiDou’s system managers and political overseers absorb the program’s accomplishments, they may preserve the nominal 2020 date for completing a full global system. The final constellation will be made up of 5 GEOs, 3 IGSOs, and 27 MEOs — a total of 35 satellites, which would make it the largest of the four GNSS systems.

However, China’s demonstrated success in launching spacecraft — including dual-launch capability for MEOs — also suggests an ability to accelerate that schedule considerably, if the nation’s leaders so desire.