As the clock runs out on the Galileo Joint Undertaking (GJU) that has guided the institutional development of the European GNSS program for the past four years, negotiators from the GJU and a consortium seeking to build and operate the system are nearing completion of a “head of terms” agreement.

As the clock runs out on the Galileo Joint Undertaking (GJU) that has guided the institutional development of the European GNSS program for the past four years, negotiators from the GJU and a consortium seeking to build and operate the system are nearing completion of a “head of terms” agreement.

A preliminary version of the document, which outlines the major points in a 20-year Galileo concession agreement, will be completed within a few weeks and a final version of slightly under 100 pages, by the end of the year. (The actual concession contract, estimated to run in the tens of thousands of pages, is expected to be hammered out over the following 12 to 18 months.)

At that time, the GJU will cease operation, turning over responsibility for signing the contract and overseeing the concession to the Galileo Supervisory Authority (GSA), headed by Executive Director Pedro Pedreira. The key remaining points in the head of terms discussion include an allocation of risks — program revenues from commercial operations, system design, and potential liability.

The talks are taking place against a backdrop of continuing development of the system infrastructure under a contract with Galileo Industries and user equipment by a variety of companies. A technical glitch in spacecraft components will delay the launch of the second experimental Galileo satellite (GIOVE-B) until 2007.

That postponement could conceivably allow the European Space Agency (ESA), which is overseeing technical development of the space and ground segments, to implement the full version of the Galileo signal on GIOVE-B rather than waiting for the in-orbit validation (IOV) satellites that are scheduled for launch in 2008. Industry sources close to the program say, however, that this could cause additional costs and delay in the program.

A two-month satellite laser ranging (SLR) campaign conducted this summer, the first of several planned for Galileo, provided initial data for accurately confirming the GIOVE-A orbits and characterizing the on-board rubidium clocks. Fourteen SLR stations took part in the campaign, which uses the laser retro reflectors mounted on the spacecraft (see the article, “First Laser Range Measurements to GIOVE-A,” in the May/June 2006 issue of Inside GNSS.)

Earlier this year, member states of ESA and the European Commission (EC), which provide the public leadership for the program, committed an additional €400 million to cover a cost overrun in the IOV phase of development. The GJU issued 70 Galileo-related projects involving more than 300 companies and €130 million under the EC’s 6th Framework Program R&D budget, according to Vincent Garbaglio, a GJU technical advisor. The 7th Framework Program (2007-2013) includes €350 million for Galileo projects under the transport category.

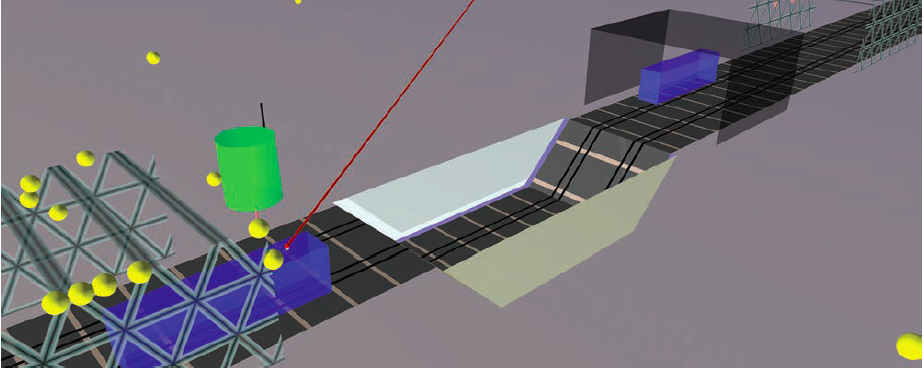

Meanwhile, GNSS receiver manufacturers have introduced Galileo receivers and other “Galileo-ready” equipment. Septentrio and NordNav, for instance, demonstrated their receivers running on a Spirent Communications simulator at the Institute of Navigation’s GNSS 2006 conference in September.

A number of manufacturers — including NovAtel, Trimble, Topcon, as well as Septentrio and NordNav — have tracked the test signal on GIOVE-A, launched last December. That signal, however, is different from the one described in a draft Galileo Interface Control Document (ICD) issued last May. A decision on the final Galileo L1 waveform — either a binary offset carrier (BOC 1,1) or a multiplex BOC (1,1/6,1) — is expected soon, although it may have to be approved by the ESA council and EU Transport Council as well as the GJU administrative board, Grohe says.

Commercial Frustrations

Despite such progress, the Galileo program is under pressure from GNSS equipment manufacturers to abandon efforts to implement fees on chipsets or license the Galileo signal-in-space, and to make the specifications of the Galileo ICD available for commercial development.

In a panel discussion at a September 25 meeting of the Civil GPS Service Interface Committee (CGSIC), representatives of three prominent GNSS vendors expressed their frustration and anxiety about the European handling of commercial issues: Javad Ashjaee, CEO of Javad Navigation Systems; Tony Murfin, vice-president for business development at NovAtel, Inc.; and Greg Turetzky, SiRF Technology’s marketing director for new product technology and IP.

NovAtel has received numerous contracts from the Galileo program through the Canadian Space Agency, which is an associate member of ESA. Nonetheless, Murfin expressed frustration at the constraints placed on commercialization of Galileo technology.

“We’ve spun off a [Galileo] receiver that we can’t sell, “ he said. “We can only use the ICD to supply the Galileo program. We don’t have a license [to sell commercial Galileo equipment openly]; we’ve tried to negotiate one.”

Murfin’s advice to Galileo authorities: “Let’s play the game the same way GPS did — publish the specs openly.”

Turetzky says SiRF is “very bullish on Galileo, but we need to resolve key technical, IPR [intellectual property rights], and business issues quickly.”

SiRF sells one million GPS chipsets a month, according to Turetzky, and is part of the iNavsat consortium subsumed in the larger consortium negotiating the Galileo concession contract. When questioned by the consortium members about market requirements and business models based on its experience with GPS, “We told them that a completely free signal would speed market development.”

As for designing Galileo into future products, Turetzky said, “We need to begin building automotive receivers for the 2009–10 model year today, but until we’ve resolved the licensing issue, we can’t do that.

“As a publicly traded company that gets analyzed every quarter, we can’t have a bunch of engineers working on interesting technical questions that don’t bring shareholders any benefit,” Turetzky said.

Ashjaee, who has designed and built GPS and GLONASS receivers for more than 20 years, repeated his previously published concerns that “by collecting the first license fee from users or manufacturers, Galileo authorities open the door for large international disputes that put the fate of Galileo in question and raise the issue of customer liability.”

He argued that the public private partnership or PPP on which the Galileo business model is funded is poorly conceived. “I basically do not know, or I should say, do not understand the current plan of Galileo as presented. . . . It is not obvious who the forces behind the Galileo project are, who is going to fund it, and who needs it to the extent that they are going to pay for it.”

Going forward, Ashjaee said, “I will work on Galileo and will assume that the Galileo authorities will work with the GPS authorities and will make a playing field such that U.S. GPS manufacturers can have the same benefits from Galileo that Europeans have from GPS.”

A bilateral working group (WG-B) on trade issues, established under a 2004 agreement on GPS/Galileo cooperation signed by the United States and the European Union, is getting under way and may end up addressing some of the manufacturers’ concerns.

Grohe on Galileo

In an exclusive interview with Inside GNSS, Rainer Grohe, GJU executive director, discussed the current state of the concession talks, the prospects for commercial receiver development, and the way ahead.

Responding to a question about commercial GNSS equipment manufacturers concerns, Grohe said, “We will give all companies access to all Galileo specifications in order to continue development.”

He acknowledged that the prospective Galileo system operator hoped to retain IPR.” The bidder for the concession is still pursuing the idea that when they are adding value, they can license [the related IP]. For instance, if you’re going for signal authentication, et cetera. But there’s no way to impose a fee on an open signal GPS/Galileo receiver.”

Grohe says he is proposing that commercial licenses be issued free of charge to companies wanting to build Galileo-capable equipment. However, other sources have told Inside GNSS that the current proposal would make these licenses of limited duration rather than open-ended.

Meanwhile, the primary focus of the negotiations with a consortium of nearly a dozen European enterprises have boiled down to sizing and allocating three sets of risks: costs and revenues from value-added services provided by the Galileo system, the design of its infrastructure, and liabilities associated with use of Galileo signals.

Grohe characterized these as purely public services, for instance, the encrypted publicly regulated service or PRS that would be used only by governmental agencies; purely commercial services, such as the higher-accuracy commercial service with guarantees of availability, integrity, and signal authentication; and a middle segment of other commercial applications that need regulation from the public sector, such as safety-of-life services and equipment carriage requirements from transportation operators.

Design risks arise from the fact that one organization — ESA — has designed the Galileo satellites and ground control facilities, issuing a nearly €1 billion contract to Galileo Industries, but another entity — the concessionaire or Galileo Operating Company — will need to implement the system and try to make a profit off of it.

Finally, the two sides are haggling over the responsibilities and allocation of costs for insuring the system against third-party liability claims brought by users worldwide. “In this, we have to be very inventive,” says Grohe.

The two sides have agreed that the insurance market will cover the major portion of the risk with a contingency/compensation fund established by both parties. Handling potential uninsured liabilities, however, remains a sticking point, with the GJU wanting that risk to be shared by the public and private partners and the consortium’s negotiators resisting any exposure to “open-ended” liabilities.

On the subject of military applications of Galileo, Grohe observed, “From a purely technical point of view, the features are there – in the PRS. If you have such an infrastructure, you should not exclude reasonable applications. But I’m not a politician and I don’t want to confuse the issue.”

Looking ahead, Grohe said, “I think that Europe has to develop its attitude. Up to now, countries and companies have concentrated on getting their fair share in the program.”

The more important question, Grohe says, is “How do we get a fair share of the market and benefits from the applications [of Galileo], which is where all the money is? Who’s going to be the leader in applications?”

Copyright 2006 Gibbons Media and Research LLC