Harris Corporation and L3 Technologies, Inc., have agreed this week to combine in an all stock merger of equals to create a global defense technology leader, focused on developing differentiated and mission critical solutions for customers around the world.

An increase in defense spending under President Donald Trump and the Republican-led Congress is driving contractors to pursue mergers so they have more scale to bid on bigger projects, including everything from upgrading computer systems to space exploration, according to a Reuters report.

Under the terms of the merger agreement — published on the L3 website at l3t.com — which was unanimously approved by the boards of directors of both companies, L3 shareholders will receive a fixed exchange ratio of 1.30 shares of Harris common stock for each share of L3 common stock, consistent with the 60-trading day average exchange ratio of the two companies. Upon completion of the merger, Harris shareholders will own approximately 54 percent and L3 shareholders will own approximately 46 percent of the combined company on a fully diluted basis.

The combined company, L3 Harris Technologies, Inc., will be the sixth largest defense company in the U.S. and a top 10 defense company globally, with approximately 48,000 employees and customers in more than 100 countries. For calendar year 2018, the combined company is expected to generate net revenue of approximately $16 billion, EBIT of $2.4 billion and free cash flow of $1.9 billion, according to the press release.

Harris Chairman, President and Chief Executive Officer William M. Brown said, “This transaction extends our position as a premier global defense technology company that unlocks additional growth opportunities and generates value for our customers, employees and shareholders. Combining our complementary franchises and extensive technology portfolios will enable us to accelerate innovation to better serve our customers, deliver significant operating synergies and produce strong free cash flow, which we will deploy to drive shareholder value. Integration planning is already underway, and from our extensive experience with integration, we are confident in our ability to realize $500 million of annual gross cost synergies and $3 billion of free cash flow by year 3.”

L3 Chairman, President and Chief Executive Officer Christopher E. Kubasik stated, “This merger creates greater benefits and growth opportunities than either company could have achieved alone. The companies were on similar growth trajectories and this combination accelerates the journey to becoming a more agile, integrated and innovative non-traditional 6th Prime focused on investing in important, next-generation technologies. L3 Harris Technologies will possess a wealth of technologies and a talented and engaged workforce. By unleashing this potential, we will strengthen our core franchises, expand into new and adjacent markets and enhance our global presence.”

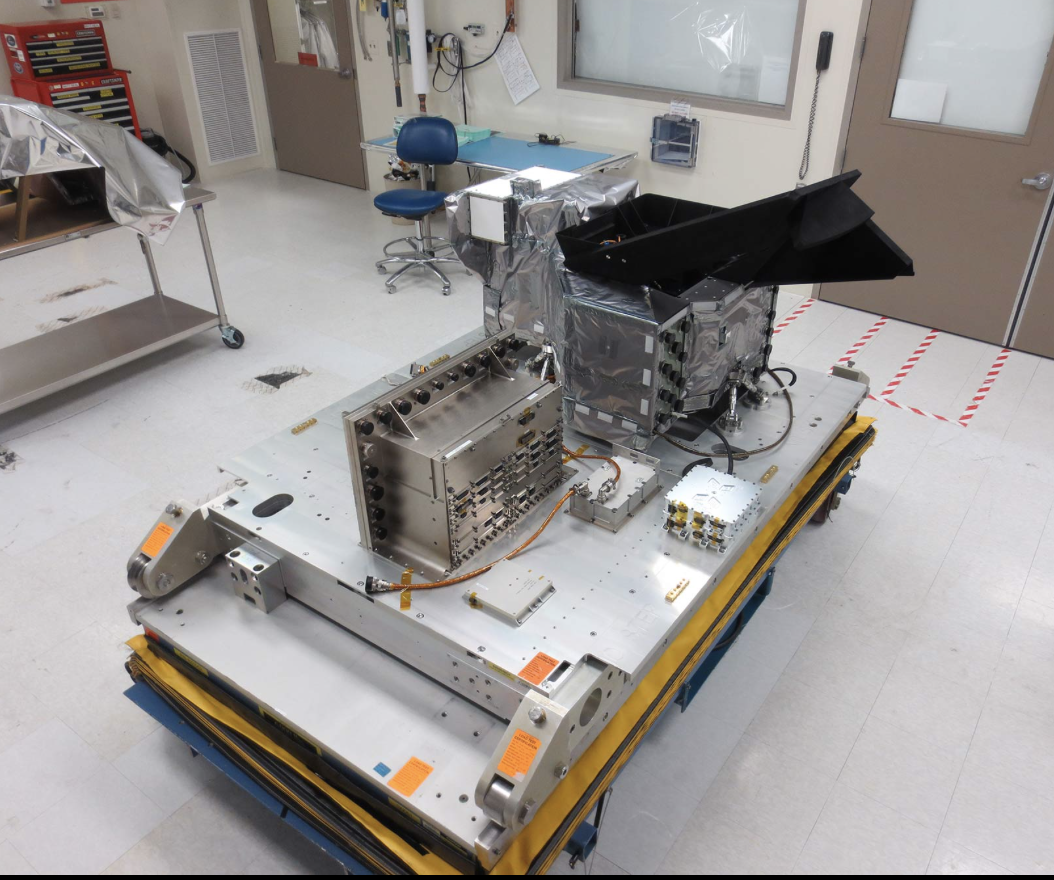

The combined portfolio brings depth and balance of relationships across a wide range of customers, in both the U.S. and international markets. Increased scale will enable the combined company to be more cost competitive, expand capabilities to provide end-to-end solutions across multiple domains of air, sea, land, space and cyber, enhance leadership in RF and spectrum technologies and establish a leading platform-agnostic supplier and integrator.

Shared Culture of Innovation

Both L3 and Harris are technology driven organizations with significant R&D investment and a combined workforce of approximately 22,500 engineers and scientists. The combined company plans to accelerate investment in select technologies to expand leadership in key strategic domains including national security. By leveraging a common operating philosophy of continuous improvement and operational excellence, L3 Harris Technologies will continue to drive operating margin improvement.

Governance and Leadership

L3 Harris Technologies will be headquartered in Melbourne, Florida and led by a highly experienced and proven leadership team that reflects the strengths and capabilities of both companies and will share equally in the integration process.

The combined company’s Board of Directors will have 12 members, consisting of six directors from each company. William M. Brown will serve as chairman and chief executive officer, and Christopher E. Kubasik will serve as vice chairman, president and chief operating officer for the first two years following the closing of the transaction. For the third year, Brown will transition to executive chairman and Kubasik to chief executive officer, after which Kubasik will become chairman and chief executive officer. Additional senior leadership positions for L3 Harris Technologies will be determined at a later date.

The merger is expected to close in mid-calendar year 2019, subject to satisfaction of customary closing conditions, including receipt of regulatory approvals and approval by the shareholders of each company.