Back in 1999, the European Union decided to set up a global satellite navigation system (GNSS), known as Galileo, for civil and commercial use. Early 2010 the European Commission awarded the contracts for Galileo’s first satellites, launchers and support services. In 2011 the European system will finalize its validation phase. As a result, the initial service provision of Europe’s satellite navigation system could start as of early 2014.

Back in 1999, the European Union decided to set up a global satellite navigation system (GNSS), known as Galileo, for civil and commercial use. Early 2010 the European Commission awarded the contracts for Galileo’s first satellites, launchers and support services. In 2011 the European system will finalize its validation phase. As a result, the initial service provision of Europe’s satellite navigation system could start as of early 2014.

To complete Galileo, the European Commission, the European Space Agency (ESA), and the European GNSS Supervisory Authority (GSA) are making a significant implementation effort — in terms of investment, research expenditure, and human resources.

This effort comes at a moment in time when the world economy is struggling to recover from a very severe economic crisis. There is little doubt that the subsequent recession has an impact on the demand for services and applications using GNSS.

Moreover, the GNSS landscape is changing rapidly, with constant technological innovation on the receiver side and a whole generation of new GNSS systems, including the upgrade of the U.S. Global Positioning System, which will come into operation within a few years.

Against this background, it makes sense to examine recent market developments and to consider the case for the Galileo program to contribute to the recovery of the European economy, making it more sustainable and knowledge-based.

The European model for recovery emphasizes the role of innovation as a motor for economic change. Space technologies and, in particular, satellite navigation, have been recognized as having a high potential for bringing wide ranging economic and social improvements.

GNSS and the Economic Recession

GNSS is similar to the Internet and information and communication technologies (ICT) in general: a service enabler rather than just a specific and finite product of a process. The GNSS business results precisely from the capacity to find creative ways to use and to improve the accuracy and utility of GNSS signals.

Because of its nature as a general purpose technology, it is difficult to apply boundaries to the GNSS business. Many different markets exist, each with particular dynamics and many different actors in the value chain. (For a detailed presentation, see GNSS Markets and Applications by Len Jacobson, Artech House, GNSS Technology and Application Series, 2007.) Consequently, ascertaining GNSS market sizes and quantifying revenues and the related employment is a difficult exercise.

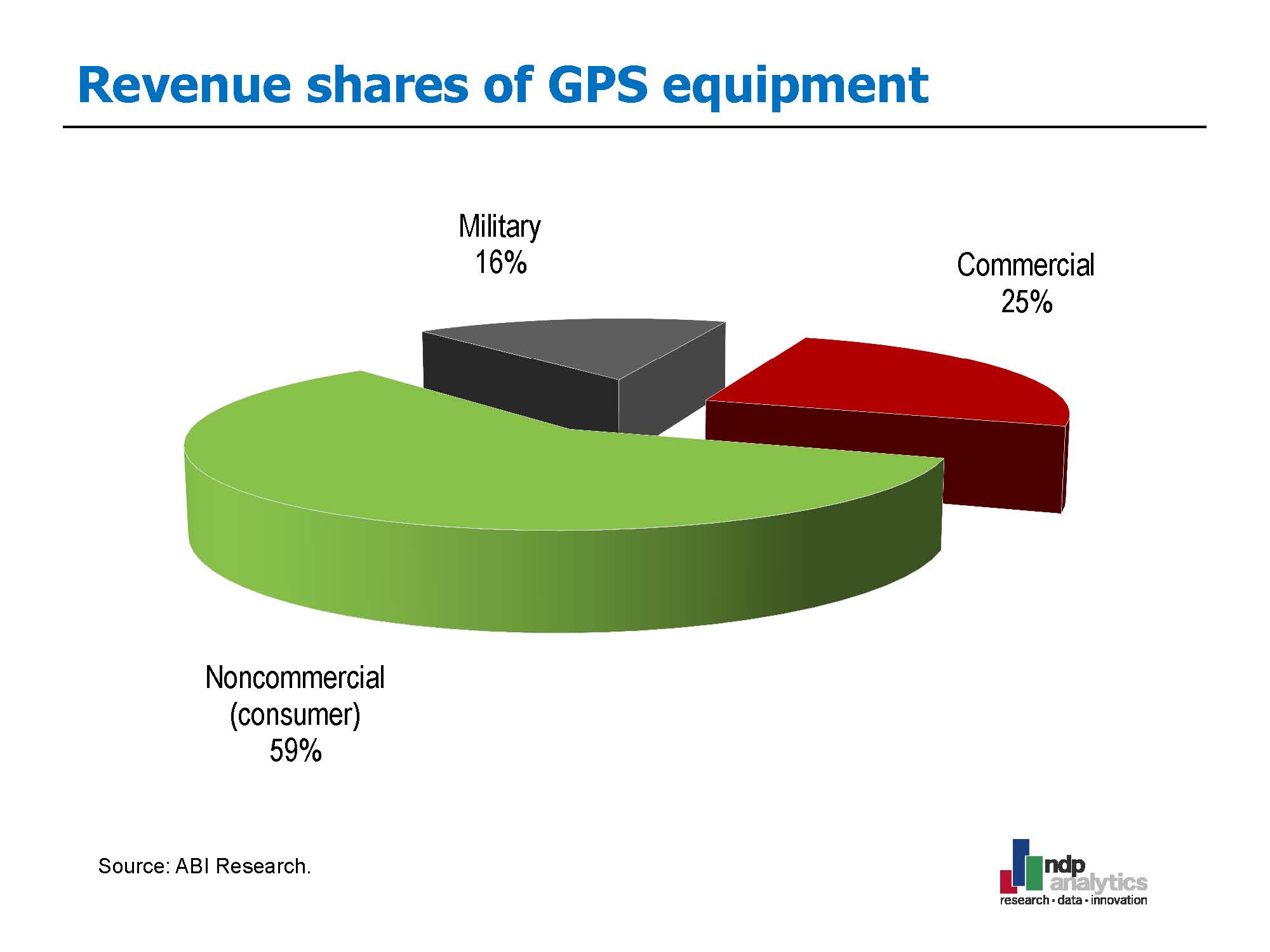

Based on a narrow definition of the value chain — i.e., GNSS receiver equipment and related software — annual market revenues from commercial (non-military) GNSS-based products and services were estimated to have been between €18 and €20 billion in 2007.

Available market research suggests a steady performance of the GNSS industry in the years prior to the economic crisis, with GNSS-enabled products and services increasing at compound annual growth rates exceeding 30 percent on average over the period 2004-2008.

Most of the growth was linked to transportation services and to personal mobile communications. However, commercial GNSS services played an increasingly important role in many professional markets, generating hundreds of millions of euros in revenues annually.

Over the past few years, progress on GNSS receiver technology has been a key factor for expanding markets. Lower prices and higher performance of sophisticated, small multi-channel receivers are at the core of the expansion of GNSS markets.

Today, GPS chipsets and receiver modules are embedded into all sorts of end user equipment. In the near future, the competitive advantage of a GNSS system could come to rely much more on receiver capabilities than on the intrinsic features of the system itself.

Moreover, the critical importance of certain applications cannot be measured just in terms of revenues. For example, GPS time applications have an enormous economic significance albeit with limited market size.

Today, among these applications are synchronization of Internet Protocol-based networks and communications networks, synchronization of electricity grids, time-tagging of financial transactions, frequency reference control, calibration of test instruments, and time and frequency distribution.

Hydrogen maser clocks planned for Galileo satellites are expected to be even more accurate than GPS clocks, which are stable to less than one second in more than a million years. Consequently, many more timing applications will likely arise using GPS and Galileo.

Projections for the Post-Crisis Horizon

The most recent market research suggests that, notwithstanding the impact of the economic crisis, the GNSS industry is still growing at a solid pace. We draw this conclusion based on a compilation and review of the more recent commercial studies on benefits derived from the Galileo system, additional studies conducted by the European Commission, the GSA and EU Member States, and business interviews with participants in the GNSS industry conducted in March and April 2009.

ABI Research forecasts GNSS system shipments (a proxy of sales) to reach more than 500 million worldwide in 2010 and to continue growing to 1.1 billion in 2014. (As noted earlier, revenue projections vary widely depending on the market definition. A broader definition covering all type of added-value applications enabled by GNSS technology would result in much higher figures.)

Current projections suggest that, over the period 2009-2013, GNSS markets will grow at compound annual growth rates of around 24 percent. In today’s crisis scenario, few other industries are granted such bright prospects.

A market study conducted by the GSA foresees that the overall worldwide GNSS “enabled” market size for civil applications — combining sales of GNSS devices plus GNSS-based services — will amount to around €236 billions in 2025.

Obviously, long-term projections have to be treated prudently. Nevertheless, market trends suggest GNSS-based products and services are still in the “early majority” phase of an innovation adoption cycle. (This observation draws on Everett Rogers’ Diffusion of Innovations Theory, which observes that by the time the “early majority” of customers get involved, most of the hard work for creating a new market has been done. The role of the “early majority” is to increase the critical mass of take-up.)

If this assumption is correct, it should mean that significant opportunities for GNSS businesses and entrepreneurs will continue for at least the next 15 years.

Galileo’s Impact on Revenues and Jobs

The question of the market benefits that can be attributed to the Galileo program alone is one that is frequently posed. Over the past 10 years, several cost-benefit analyses and market assessments have been carried out. They focused on the estimation of market revenues in the upstream and downstream markets and of jobs opportunities that could derive from European Union usage of Galileo.

However, clear externalities and other non-quantifiable effects are not included in the traditional cost-benefit approach. Those refer to macro-economic effects, for example, in terms of productivity gains across industry, and public benefits such as reductions in road congestion, lower carbon-dioxide emissions, and improved levels of safety and security (lives saved, accidents avoided and so forth).

Just in terms of market opportunities, according to estimates produced in the pre-crisis period, Galileo had the potential to generate €100 billion of accumulated revenues for European companies in the global market for navigation applications in the period 2005-2030. Such an outcome would lead to the creation of as many as 100,000 high-tech jobs across Europe, according to these studies.

A review of these estimates taking account of the possible impacts of the economic crisis suggests that, in a worst-case scenario, the total accumulated benefits coming from Galileo over the period 2008-2030 would be between €55 and €62 billion.

This “less optimistic” or worst-case scenario assumes a very low penetration of Galileo-based services in European and world markets for GNSS services. It takes account of direct and indirect effects on both GNSS upstream and downstream markets.

Even under this pessimistic scenario, the accompanying increase in employment is projected to produce around 1,400 permanent jobs created in up-stream industries — Galileo infrastructure and operations — and between 17,000 and 21,000 incremental jobs in down-stream industries — Galileo product manufacturers and service providers.

Somehow, these “bottom line” figures confirm expectations placed on Galileo. Moreover, if the overall GNSS market will bring significant benefits to Europe, some of these benefits will be incremental and generated only thanks to the introduction of Galileo. Although difficult to quantify too, those benefits have a tremendous economic significance. They appear in the form of opportunity cost, competitive edge, and know-how.

Opportunity Cost. Galileo will provide redundancy in case of a degradation of GPS signals and, therefore, will cover the cost of lost opportunities for Europe of not having such a backup capability. A degradation of available GNSS signals would entail significant costs in terms of impact on logistics, road congestion, and safety risks in the transportation sector. Professional activities based on GNSS would also be affected, as well as the communications and financial networks that depend on GNSS-based precise time and synchronization.

Assuming that by 2014-2015 revenues from GNSS-enabled devices and applications for civil applications in Europe represent around €60 billion (a conservative hypothesis), this amount can be taken as a rough estimate of the cost opportunity in terms of revenues lost in case of serious disruption to GPS open signals. However, the collateral damage arising from disruption of transportation, logistics, and other critical services could significantly exceed this estimate.

Competitive Edge. Galileo has been primarily conceived for civil purposes — a feature exclusive to the European sponsored GNSS.

From a market perspective, the provision of a commercial GNSS service and the possibility of adapting open signals to civil users’ requirements can entail a definitive competitive advantage for Galileo. Such a possibility could support the growth of existing markets and further penetration of GNSS-based applications in various economic sectors.

In addition, today users do not have any enforceable rights concerning the continuous availability and level of quality of GNSS signals. The Galileo service guarantee for the commercial and safety of life services could also represent a unique market opportunity for Galileo services worldwide.

Know-How. The European Union is already one of the most important markets in the world for GNSS services. In the coming years, the use of GNSS-based services in various sectors of the European economy can be expected to increase further. According to projections from the GSA, the revenues generated by location-based services are expected to grow at an annual rate of about 23 percent between 2007 and 2015.

Among the key factors supporting this market growth potential are the openness of end users to adopt new technologies and the availability of skilled human capital and entrepreneurial resources able to exploit the possibilities opened up by GNSS technology.

Galileo’s Long-Term Stimulus Package

When considering the issue of the contribution of Galileo to recovery from the economic crisis, an element that cannot be ignored is that the investment being made by the European Union is already being paid back.

The funds committed to date in support of the European Global Navigation Satellite System total €5.6 billion. This amount, covering the period 1999-2013, also includes the development of the in-orbit validation phase of Galileo satellites as well as the European Geostationary Navigation Overlay Service (EGNOS) an augmentation system that enhances the integrity, accuracy, and operation of the satellite navigation systems.

Completion of the European GNSS project will require additional funds — to be approved in due time by the European Parliament and Council —for the exploitation phase of Galileo. This also includes the improvement and renewal of the system in the period 2014–2019.

In essence, a long-term political commitment will now be required to ensure that the technical performance and reliability of Galileo are guaranteed for the foreseeable future, meaning well into the 21st century.

Without prejudging the additional funding that will be required for Galileo, we should noted that, in terms of the size of the budgets allocated for the support of big European civil works — e.g., sizable trans-European infrastructural projects — the cost of the European GNSS is modest. For example, the cost of the rail link between Berlin and Palermo exceeds €47 billion while the construction of the Brenner base tunnel between Austria and Italy will cost €4.5 billion.

Expenditures on the civil Galileo system will remain significantly lower than the overall cost of GPS, a system operated by the U.S. Air Force and designed for military applications as well as civil and commercial uses.

In 2006, the USAF GPS Joint Program Office estimated at $26 billion the overall cost of the GPS system up to that fiscal year, for the 31 satellites and the control segment. At the time, it projected that an additional $9 billion package will be necessary to build a modernized GPS, i.e., GPS III, with the first upgraded satellite operational during the fiscal year 2013.

In April-May 2009, the U.S. Government Accountability Office reported significant cost increases and schedule delays in the acquisition of new GPS satellites and in the required upgrading of ground control and user equipment. Taking into consideration these latest developments, a rough estimation of the total cumulative cost of the GPS system, including the GPS III upgrade, would amount to about $40 billion.

However, for Europe, Galileo represents a productive investment in a general-purpose technology that requires the support of a solid high-tech industry as its backbone. Far beyond the benefits that can be expected from civil work projects, a very important spill-over from Galileo is the knowledge base being built up for the European space industry.

The money expended on the Galileo program thus far has already contributed to the training and specialization of a new generation of European scientists and created opportunities for a wide range of companies in the upstream markets and for universities across Europe.

Interoperability: Helping Maximize Benefits for Users

In a few years time, the GNSS landscape will change completely. In addition to GPS and GLONASS, the Galileo, Compass, Indian regional navigation satellite system, and Japan’s Quasi-Zenith Satellite System will also come into operation.

From the point of view of civil applications, GNSS system interoperability is a market enabler:

- offering better accuracy and availability to end users

- guaranteeing a back-up capability in case of signal degradation

- reducing the risk of market fragmentation, which emanates from the existence of GNSS systems operating independently.

Interoperability would pave the way for the development of common interfaces and facilitate GNSS penetration into mobile devices and user equipment in general. It would generate economies of scale, lower production costs, and create more robust equipment and applications.

To a large extent, GNSS market growth has been supported by a constant improvement in chipsets and receiver technology. Interoperability would lead to a faster pace of innovation, more satisfied end-users, and new applications attracting new customers — hence, to further growth in the market.

A concerted international effort to agree the basic governance rules for satellite navigation infrastructures for civil usage at a world-wide level is of prime importance. The compatibility and interoperability of systems would enlarge the size of the relevant markets.

The case of the Internet, which has become an engine of economic growth in which the consolidation of diverse but interoperable infrastructures has already taken place, provides a good precedent.

GNSS: a Long-Term Investment for Europe

When considering market developments and the importance that GNSS commercial services have acquired in recent years, some key conclusions become apparent:

1. GNSS represents a long-term growth industry, with potential revenues in the range of tens of billions of euros, even in a context of a severe economic crisis.

2. Today, the European Union is the most important market for GNSS products and services after the United States. In the next 15 years, European economic dependence on GNSS will increase.

3. Galileo represents a productive investment in a general-purpose technology that will help to regenerate the European economy. The overall cost of Galileo will be low in comparison with the direct and indirect benefits — in terms of revenues, jobs, and productivity gains — that can reasonably be expected from it. From the perspective of a recovery plan, Galileo is a sure bet for building up a lasting competitive advantage for Europe in the post-crisis scenario.

4. The consolidation of a global GNSS backbone infrastructure is a key requirement for ensuring the long-term growth of commercial GNSS applications. With the coming into operation of new systems, the international framework for addressing, inter alia, problems of compatibility and liability issues will have to be reinforced. This will create market certainty for investors and safeguard service levels for critical civil GNSS usage.

Additional Resources

[1] Council Resolution of 19 July 1999 on the involvement of Europe in a new generation of satellite navigation services (C 221/01/1999)

[2] European Commission, Energy and Transport: Galileo http://ec.europa.eu/transport/galileo

[3] European Commission, Enterprise and Industry: Space http://ec.europa.eu/enterprise/policies/space/index_en.htm

[4] Hein, G., and S. Wallner, J-H. Won and T. Pany “Working Papers: Platforms for a future GNSS Receiver,” Inside GNSS, March 2006