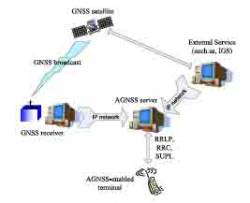

AGNSS Technique. Nokia graphic

AGNSS Technique. Nokia graphicFinland’s Nokia, the world’s leading manufacturer of mobile phones, is investigating use of GLONASS signals in new products that could reach the market in the near future.

Finland’s Nokia, the world’s leading manufacturer of mobile phones, is investigating use of GLONASS signals in new products that could reach the market in the near future.

Tired of waiting for Europe’s Galileo system to come on-line and looking for features that can differentiate their products in the fiercely competitive handset marketplace, Nokia has conducted extensive study of the suitability of including Russia’s GLONASS in network assisted-GNSS (AGNSS) solutions in addition to GPS. Nokia predicts that 30-40 percent of cellular handsets sold within three to four years — about 300 million phones per year — will use AGNSS.

The attention of Nokia could give a substantial boost to the Russian system, which has recently come under criticism from the country’s First Deputy Prime Minister Sergei Ivanov. Ivanov has recently complained that GLONASS does not yet provide enough global coverage for users, is less accurate than GPS, and GLONASS-capable user equipment is not available to consumers.

Although Russia has signaled its intention and desire for GLONASS to find a place in consumer markets, the system has until now been used primarily by commercial manufacturers of high-precision (and expensive) specialty equipment and by Russia’s defense sector.

In a presentation at the (U.S.) Institute of Navigation’s National Technical Meeting in San Diego on January 30, Nokia engineer Lauri Wirola described a lengthy investigation conducted last autumn that tracked GLONASS satellite signals and evaluated their ability to be combined with GPS in AGNSS solutions on mobile phones.

Wirola said the study indicates that the modernized GLONASS satellites — GLONASS-M — will be stable and accurate enough to be used — despite differences in the GPS and GLONASS system time scales, frequencies, signal structure, and geodetic coordinate system.

“We cannot afford to wait for Galileo,” Wirola said, referring to the 2012–13 timeframe for the system’s completion. “That’s why we are looking so closely into GLONASS.” He said that Nokia is talking with major GNSS chipset manufacturers about the prospects for building GLONASS into OEM receivers intended for mass markets.

In addition to providing more signals in general, the GLONASS system offers other advantages. The orbital inclination of the satellites in its three-plane constellation brings GLONASS spacecraft much higher in the sky than GPS, making their signals less likely to be masked by buildings or terrain. That same feature also decreases the geometrical dilutiuon of precision (GDOP) factor, a figure of merit that translates into improved accuracy for GNSS position fixes.

In its recent fourth-quarter 2007 report, Nokia announced shipments of 133.5 million handsets, up 27 percent from a year ago. The company’s share of the mobile phone handset market grew to 40 percent, according to Nokia, while its profit jumped 73 percent in the quarter and revenue climbed 49 percent. The company is predicting 10 percent growth in 2008 unit sales.

AGNSS uses information provided through the telecom network itself — such as the current orbital location of satellites and a rough approximation of the user’s location — to accelerate the time to first fix (TTFF) of a GNSS position.

"The consumer doesn’t want to wait 30 seconds for that first position fix," said Wirola. The goal of AGNSS is to bring TTFF to under 10 seconds.

International industry-based standards groups, including the mobile phone–oriented Third Generation Partnership Project (3GPP) and Open Mobile Alliance, have been evolving first an assisted-GPS standard in the 1990s and more recently an AGNSS standard with "place-holders" that incorporate Europe’s Galileo system and, provisionally, GLONASS.

Although the Galileo component has been implemented, Wirola said that political factors appear to be inhibiting the activation of the GLONASS AGNSS standard.

He said Nokia shares the concern of other handset manufacturers that the Russian program, which has been launching modernized satellites steadily, might experience another interruption such as occurred following the collapse of the Soviet Union.

"Russia can launch satellites, but will a mid-1990s-type collapse occur if, for instance, it runs out of oil [revenues]?" Wirola said. Nokia, however, appears to be ready to wager that such a situation won’t recur and that GLONASS will provide a signal resource ahead of other GNSS providers.

Another development that could encourage adoption of GLONASS for consumer products would be broadcast of a CDMA (code division multiple access) signal in addition to the FDMA (frequency division multiple access) signals presently transmitted by the satellites. Russia had set itself an end-2007 deadline to make a decision on CDMA, but no decision has been announced yet.

As of February 2, the GLONASS constellation had 15 operational satellites transmitting signals and another satellite — the last of three GLONASS-M spacecraft from the most recent launch December 25 to come on-line — in the final phase of commissioning. Another six satellites are scheduled for launch later this year. According to the Russian Federal Space Agency (Roscosmos), once the three GLONASS-M satellites launched in December 2007 are put into service, 95 percent of Russia’s territory and 83 percent of the world will be covered by sufficient GLONASS signals for navigation and positioning.

Several North American and European manufacturers offer combined GPS/GLONASS OEM products, including NovAtel, Javad GNSS, Trimble, and Leica. Several domestic organizations — including the Russian Institute for Space Device Engineering, the Russian Institute of Radionavigation and Time, and the JJ-Group — are working on designing GLONASS/GPS chips. It remains to be seen, however, how soon high-volume low-cost GLONASS chipsets will become available for use in products developed for consumer mass markets.