Miguel Manteiga Bautista

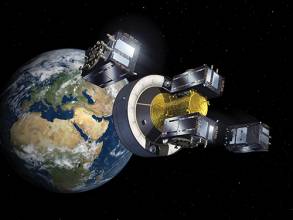

Miguel Manteiga BautistaThe first generation of the Galileo Program, at satellite and ground segment level, has been “an enormous success,” according to Miguel Manteiga Bautista, who recently spoke with Inside GNSS at his office at the European Space Agency’s European Space Research and Technology Centre (ESTEC) in Noordwijk, Netherlands.

The first generation of the Galileo Program, at satellite and ground segment level, has been “an enormous success,” according to Miguel Manteiga Bautista, who recently spoke with Inside GNSS at his office at the European Space Agency’s European Space Research and Technology Centre (ESTEC) in Noordwijk, Netherlands.

We started by asking Manteiga how he felt about the recent declaration of Galileo Initial Services and he was quick to point out some impressive achievements as well as take a look ahead at how things may develop in terms of adapting to the user, and to future market needs.

“We are providing performances similar to or in the range of other systems, with several times less mass at satellite level, which is a tremendous technological achievement,” he said. “But, for the future, once you have the first generation in place, the EC, ESA and the European GNSS Agency (GSA) are thinking ahead about how to adapt to the user, to future market needs and to technological innovation.”

Manteiga has been with the European Space Agency (ESA) since 2001, first as systems telecommunications engineer, then head of unit and head of division in the Galileo Program. Since 2015, he has been ESA’s head of GNSS Galileo Evolutions Program and Strategy Division. His team is in charge of designing future European GNSS Systems and associated research & development (R&D), under ESA’s European GNSS Evolutions Program and the Horizon 2020 Delegation Agreement established with the European Commission (EC).

“It’s a pleasure,” he said. “The feeling is that after 15-20 years of hard work by public and private sector entities developing the first generation, all these efforts are officially recognized and become reality. We already knew the program was needed and made sense, but now it is a reality and it’s a very gratifying experience.”

With Galileo now official with 18 functional satellites in orbit, what does it mean for the typical “person on the street”?

A man, holding up a smartphone, says, “Galileo is on? Show me.”

Manteiga said, “Will the mass market user physically notice? From the performance point of view, there will be improvements perceived by the users, mainly in terms of robustness and performance in challenging environments; in particular, for applications that rely only on GNSS. In addition, for specific services like search and rescue, the users will significantly benefit from them.”

And, he said, what the manufacturers know and what the suppliers know is that GNSS is becoming progressively more reliable. “GNSS performance is better, and making a higher contribution to navigation solutions that use a variety of sensors, which basically opens the possibility of new applications, or applications that rely a bit less on other systems and a bit more on multi-GNSS.

A Challenging GNSS Evolutions Concept

“With this first generation of Galileo, at satellite and ground segment level, the Galileo Program has been an enormous success,” said Manteiga. “We are providing performances similar to or in the range of other systems, with several times less mass at satellite level, which is a tremendous technological achievement.

“But, for the future, once you have the first generation in place, the EC, ESA and the European GNSS Agency are thinking ahead about how to adapt to the user, to future market needs and to technological innovation.”

The three bodies that make up the European “space triangle” are watching two major market trends very closely, according to: “You have hybridization, multi-sensor, all the non-GNSS-only technologies on one side, and on the other side we see all the GNSS systems significantly expanding their global component capabilities, with the evolution programs of GPS, GLONASS, BeiDou and also the advances of other systems like QZSS/IRNSS (Quasi-Zenith Satellite System/Indian Regional Navigation Satellite System).

“In addition, we have seen – and this is a problem for all GNSS global systems – that the time to market is 15 to 20 years from Phase 0 till the declaration of Full Operational Capacity, while time to market for local added services is just six months to a year.”

Manteiga started with the ESA in 2001 and worked on first-generation Galileo for 15 years. He added that other services, like L5 GPS, require a similar period to reach full operational readiness.

“So one of our common objectives for the Galileo second generation – and this has never been done before – is to shorten the time to market for implementing new services and new requirements, in line with the time to market for local added services. This is a very challenging goal, and we are doing a significant amount of R&D to achieve this.”

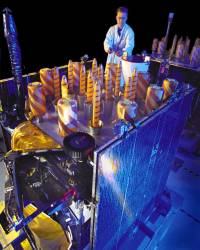

The way you do it, Manteiga said, is by building in flexibility. The R&D being carried out under associated European Union and ESA R&D programs is not tied to today’s specifications, he said. “It has growth capabilities embedded. At payload level, at ground level, the way you build the ground, the way you upgrade the ground, the way you build your payload capabilities,” he said. “Like the signal generator, the way you build all your components is to create a capacity for future service improvements while controlling the design cost. This creates an R&D loop that would potentially allow us to achieve this time-to-market aspiration.

“It is basically about driving the flexibility of the margins, in order to implement new capabilities for the user. We don’t design according to today’s needs as we cannot precisely forecast what users will need in the future.”

And, he said, “It is important to highlight that the definition of European GNSS Evolutions and the associated processes and objectives are a common R&D effort of ESA, the EC and GSA, with ESA leading the GNSS Evolutions design activities for the future systems.”

Future-Proofing

Alongside flexibility, Manteiga pointed to another pillar for Galileo Evolutions: “Much of our R&D activity is oriented towards increasing significantly the robustness of the system, so that it can act as a strong and reliable backbone, not necessarily as a sole provider of services but as a backbone that can be augmented locally by other PNT (positioning, navigation and timing) technologies.”

The objective, Manteiga said, is to provide a stable and robust global service, so that providers can pick it up in rural areas without augmentation, or in urban canyons with a high level of augmentation.

“Let’s not forget,” he said, “we don’t have just one set of users. The percentage of Galileo’s contribution will be different for different users in different environments. In a terrestrial network, out-of-coverage area like rural United States or rural Europe, 90 percent of the user contribution will be the global system. But when the user moves into an urban environment, the GNSS becomes the backbone, providing a stable service and timing reference, but with a higher local augmentation contribution.”

This is similar to a telecom provider being used as a backbone for provision of added-value services by third parties.

Manteiga said he does not expect GNSS to be made obsolete by new technologies: “You know, Graham Bell was once asked if he thought land lines would ever disappear. I worked in the telecommunications market sector before I started in ESA – all the market players were talking 20 years ago about how ‘the land lines are dead’. But the land lines are still here, and added-value services are being provided on top of them. When aircraft were invented, people wondered whether roads would disappear. The roads and highways are still here. In the same way, a global backbone infrastructure provided by navigation satellites will always be here and complement other systems.”

Manteiga cited the GSA’s analysis of market trends, as well as ESA studies on technology improvements that indicate GNSS navigation, while already a huge sector, is still in the early stages of development. “There are many different user needs, like mobile data was 20 years ago, with users demanding more and more and the rise of ubiquitous services.

“There is room in the market for all systems. But a homogeneous GNSS backbone with an embedded delta capacity means that when new user needs come up, when developers have new ideas in the next two decades, we can satisfy fully or partially these needs without requiring 15 years of re-development.”

No Breakthroughs, But Radical Nonetheless

“There is no new GNSS technology breakthrough that changes everything,” Manteiga said. “When you see how current GNSS systems are planning to evolve, there is nothing radical. In the end, it’s a technology that has been quite stable since the end of the last century.

What all the GNSS systems are doing is improving robustness and performance – different GNSS systems have announced that their next-generation satellites will significantly improve stand-alone performance.

“But on the other side, a GNSS constellation that performs significantly better and is flexible is a radical change. We are not pointing at a specific technology. It is not a technology push, but process-related improvement and a continuous R&D philosophy. A global satellite system that can update its service provision in a much more frequent manner than every 15 years is a radical concept change. We have to see how we implement it, what the constraints are for this flexibility, and so on, but it’s a mindset that is really embedded in our activities.”

Manteiga said suppliers, the non-GNSS sector, and the PNT sector all are looking for something they cannot get from the global system. This is why they use local augmentation solutions that unfortunately are not scalable for a global environment. They can only implement such solutions in high-revenue areas like big cities.

“Of course we have to invest in our strengths. There is little added value to investing a huge amount of R&D effort on topics that are only linked to local augmentation for mass market,” he said. “Our strength is not local. We will never compete with terrestrial short-range systems. Europe has to invest – and this is what other GNSS systems are doing – in the strengths of the global system.”

Other GNSS Systems

So, what will the other GNSS systems look like in the future? Will they all look the same, or will they all look different?

“To predict the ideas of some engineer in 10, 15 years is a very challenging affair. Every system has its own constraints, different weights for the different services they provide,” said the ESA’s head of GNSS Galileo Evolutions Program and Strategy Division.

For now, though, all the major GNSS systems do seem to be converging on similar bands, similar technologies and similar evolution strategies.

“The user cannot afford to have navigation in different bands and modulations because miniaturization is one of the key objectives at user level,” Manteiga said. “What is clear for us is that navigation is growing exponentially. We see it everywhere. It has not yet arrived on the mobile phone; from a GNSS point of view it has, but not from a local navigation point of view. But in 2030-2040, we are forecasting that inter-mobile ranging will be a fact. It cannot be implemented today for many reasons – processing, power, miniaturized stable clocks and other constraints. But we are convinced that the mass-market local navigation environment will include interpersonal device ranging based on a robust GNSS reference.”

Because of this, he said, the objectives are focused on the strengths of the global system and its flexibility to bring forward added-value services, and not so much on local environment augmentation, which will come about sooner or later.

“For the specific Galileo services that are not mass market-related, the story is different, as the global system will provide a larger contribution. Therefore, the global system will still require a very good level of performance in order to deliver these global non-mass market services.”

Healthy Exchange

Not only are the global satellite systems converging, said Manteiga, but the communities are also reaching out to one another. Under the coordination of the EC, Europe’s GNSS team meets with representatives of other global GNSS programs several times a year.

“We see each other at all the conferences and we all talk to each other,” Manteiga said. “For example, at ION (Institute of Navigation) we had a combined panel on BeiDou and Galileo evolutions. And during our presentation on Galileo evolutions, it was the other GNSS teams who had the most questions – ‘We also wondered about that’, they said, regarding some of the technological trends presented. ‘Why did you do this? Have you considered that?’ They were asking the same questions that we, EC/GSA/ESA, ask ourselves. They have the same issues – where to go, how to evolve, how much to evolve, in one step, in 10 steps.

“I’m not saying we share all the details, I’m not saying ‘openness’ in a naive way, where you see all the designs. But the level of communication of GNSS providers about plans, what we are doing, what we are studying, and what trends we see, it is really remarkable compared to when I arrived in the space field and in navigation in particular. Back then there was a sense of competition between the systems. This has radically changed in the past 15-20 years.”

He added that all the systems have realized there is room for multi-GNSS, and that local augmentation is also part of the end solution, part of the contribution to the user. All of the systems are just trying to improve, to get better and to ensure user needs are satisfied.

State of Play

As for Galileo Evolutions, Manteiga said, “We are in an open-minded, brainstorming phase, similar to what we saw in the recent past with other systems, where they started with six or seven evolution scenarios. Europe has several evolution scenarios, varying from very little evolution to more advanced evolution.”

Considerations include trade-offs for all types of technologies at this stage and Europe’s plans are to begin Phase B activities in 2017, through the H2020 HSNAV Program, carried out by the European Space Agency on behalf of the European Commission.

“We are looking at a wide range of technologies, to bring them from experimental low-level breadboard Technology Readiness Level (TRL) to a Medium TRL in 2019. So, together, ESA, the EC and the GSA will spend two to three years to complete this process of brainstorming and selection of technologies and scenarios, up to 2019,” he said.

“From there, we will define the path forward for Galileo Evolutions activities, taking into account the cost-benefit analysis for each use case identified. This will enable us to target additional capabilities for constellation replenishment around 2025.”

Final Thoughts

“When we talk about positioning,” Manteiga said, “it’s always about the comparative weight of the global systems and the local systems, so the more satellites and the more global systems you have, the more their weight increases. And the same happens with improvements to local augmentation technologies.

“It’s like a balance effect. It’s not that they are competing with each other, but they are feeding each other, generating resonance effects and thus improving together. In the end, what really matters is that the overall solution and the portfolio of services gets progressively better. As a consequence, over the last decade, the applications and navigation markets have grown exponentially each year.”

Manteiga insisted that it’s not a competition to see who has how many satellites, or which ones are the best satellites to use. It’s that the overall navigation sector keeps growing.

“The question that moved everybody in the past was ‘Which system is better?’ “ he said. “This question is in the past now, and the answer is that all of the constellations and all the other systems are contributing to the same solution.

“There is a significant increase coming in the navigation market and there will be enough space for all the systems, each of them with their strengths and weaknesses depending on the use case.”