Europe’s Galileo program continues to struggle through a difficult passage as it looks ahead to crucial meetings of the European Union (EU) transport, economic, and heads of state meetings in November and December.

The lingering death last spring of the public-private partnership (PPP) approach to building Europe’s GNSS threw the program back into the political crucible that has always proven more arduous than the technical challenges.

Europe’s Galileo program continues to struggle through a difficult passage as it looks ahead to crucial meetings of the European Union (EU) transport, economic, and heads of state meetings in November and December.

The lingering death last spring of the public-private partnership (PPP) approach to building Europe’s GNSS threw the program back into the political crucible that has always proven more arduous than the technical challenges.

In September, the European Commission (EC) Directorate-General for Energy and Transport revealed its plan for 100 percent public financing of Galileo’s €3.4 billion deployment costs by transferring money from agriculture, administration, and research categories in the current EU budget.

In a document titled, “Progressing Galileo: Re-Profiling the European GNSS Programmes,” the commission discussed the revenue sources, technical oversight responsibilities, and redistribution of authority that it thought needed to move the program from a PPP to a publicly implemented infrastructure.

The Transport, Telecommunications, and Energy Council generally reaffirmed its commitment to the Galileo program in an October 2 meeting in Luxembourg without resolving some underlying differences of how to fund the system. However, several EU member states have taken exception to the EC’s plan, and the issue is now circulating among the transport and economic ministers’ council, the European Parliament, the EC, and various other EU institutions.

Meanwhile, the apparent lack of a Russian module for the Soyuz rocket scheduled to carry the second Galileo In-Orbit Validation Element (GIOVE-B) satellite into space before the end of the year has delayed launch until March 2008. Missing is the Fregat module, the portion of the Russian rocket that releases the spacecraft into its final orbit.

GIOVE-B, which suffered a devastating electrical incident during tests in the summer of 2006, has been moved to the European Space Agency’s (ESA’s) technology center in Noordwijk, The Netherlands, for final testing.

Between the technical and political obstacles, the Galileo system is now not expected to be fully operational before 2013 — five years after its original target date of 2008. Commercial operation of the European Geostationary Navigation Overlay Service (EGNOS), a satellite-based augmentation system similar to the U.S. Wide Area Augmentation System (WAAS), would be put back a year until 2009 “due to ongoing prequalification work.”

In the September 19 communication to the transport council and the European Parliament, the Directorate-General of Energy and Transport had laid out a plan that would rechannel funds from the EU’s current multiyear budget to eliminate a gap in financing the program.

The proposal, advanced by EC Vice-President and Transport Commissioner Jacques Barrot and endorsed by the European Parliament, suggests plugging the gap mainly with unused EU funds earmarked for administration expenses and the agricultural sector.

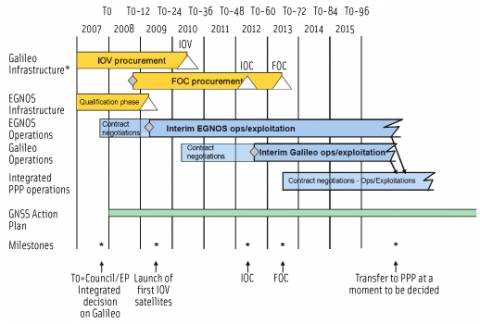

The proposal also anticipates delayed completion of the In-Orbit Validation (IOV) phase, which involves the launch and testing of four satellites. The new target date is mid-2010 rather than the end of 2008. IOV satellite launches would begin in 2009.

Waving the European Flag

In addition to jettisoning the idea that private industry would underwrite two-thirds of Galileo’s cost through a PPP, the EC has even more firmly embraced the sovereignty principle, the real factor behind much of the backing for Galileo. “We cannot let Europe lose its independence in this strategic sector,” Barrot argued in supporting the EC proposal on a wholly public European GNSS.

“Failing to take the appropriate decisions on a European GNSS programme, Europe would decide to rely for the mid to long term on foreign GNSS signals with little to no control over quality, availability or price of the latter,” the EC communication states.

“In addition, the ensuing loss of resident European expertise on GNSS would be coupled with a major loss of macro-economic opportunities for European manufacturing and service companies. There would be no basis for European-led space innovation for the foreseeable future.”

The communication also reflected European fears of losing out in the global GNSS marketplace. A staff working document accompanying the communication cites the 2006 ProDDAGE market study that predicts a €450 billion annual GNSS product and services market by 2025.

“Europe can not afford to be absent as an important player in this field,” the communication argues. “It is obvious that the GNSS system providers will have an important influence over all essential decisions affecting the GNSS users, such as defining or updating the standards, ensuring the continuity of access locally, defining industrial export control policy, serving the future needs of the users through system modernization.”

Transport Ministers — Yes, But. . . .

The ministers acknowledged the work of the EC, the EU’s executive branch, which had drafted a new proposal in response to a June 8 request from the council. Although Barrot was the lead spokesman on behalf of the plan, the EC proposal undoubtedly reflects the guidance of Matthias Ruete, appointed early last year as Director-General of Energy and Transport (DG-TREN).

Ruete is not new to the Galileo program. From 1998-2000 he served as director of international relations, trans-European transport and infrastructure networks, within DG-TREN and oversaw the program through a critical passage leading up to the EC’s decision to advocate for a full-fledged GNSS system.

In order to achieve a fully operational system by 2013, the EC timeline calls for a decision by the council and the European Parliament within a couple of months (see accompanying figure, Galileo Program Schedule).

After their first look at the EC plan to complete the system under a more traditional public procurement process, the transport ministers confirmed their intention “to take an integrated decision on the European GNSS before the end of the year.” In any case, that decision will need the approval of the EU Economic and Financial Affairs Council (ECOFIN), which meets next in November, for any changes in the financial plan.

The transport council and economic ministers, who must authorize any reprogramming of funds, will meet again in November to deliberate the program. The EC is pushing for a decision by the European Council of prime ministers before the end of the year in order to meet the 2013 target date.

Triple Dilemma

The political decision on Galileo revolves around three different issues: financing, deployment, and governance of the system — and, somewhat surprisingly, the third may prove the most substantive.

The EC communication and an accompanying proposed regulation would also designate ESA as the “design authority” for Galileo that would oversee deployment of the system under a contract with the EU.

Finally, the EC plan would impose several substantial changes in governance of the program, bringing under its jurisdiction the European GNSS Supervisory Authority (GSA)— a semi-autonomous European Community agency established to oversee the concession contract and perform other important functions in the Galileo program.

Under the PPP, a consortium of private companies would have contributed two-thirds of the cost of deploying the system in return for a 20-year concession contract to operate the system, which includes fee-based as well as free services. The EU would have paid the other third.

Without the industry contribution, the EC will need to eliminate a funding gap between the slightly more than €1 billion allocated for the public share under the PPP and the €3.4 billion projected to make the 30-satellite system fully operational by 2013. The plan unveiled last month would take €2.1 billion from other line items in the EU’s 2007-8 budget and €300 million from budgeted for GNSS research and development under the so-called 7th

Framework program of European capital investment.

Although industry investment in the Galileo infrastructure now appears unlikely, substantial revenues are still expected from the system under the EC’s plan. These range from €4.6 to €11.7 billion and would be used to cover operational, maintenance, and replenishment costs. The large margin of uncertainty reflects the sizable unknowns and associated risks that doomed the concession talks.

The system revenues would come from service charges for “special use” charges on the Open Service, such as location authentication for collecting road tolls, fees on other specialized Galileo services (such as the encrypted Public Regulated Service or PRS), and royalties and intellectual property rights (IPR) fees on receivers and user equipment. Service revenues would be collected by a concessionaire that would take over operation of the Galileo once it’s built.

Trio of Dissent

Since the EC’s proposal became public, Germany, the United Kingdom, and The Netherlands have expressed doubts about the new approach proposed by the EC. German Transport Minister Wolfgang Tiefensee would prefer to see individual states contribute the extra funds to ESA, which would finance and manage the project.

Germany, in particular, is driven by anxieties that German companies would not receive a proportionate share of Galileo contracts under EC rules, which generally support competitive practices without a requirement for national allocations. ESA practices a policy of juste retour, which mandates that at least 90 percent of funds contributed by a member-state to a program will return in the form of work on related project for companies in that nation.

In the amended proposal for regulation of Galileo, the EC calls for a multi-annual agreement with ESA covering the technical aspects of Galileo and EGNOS, which would “provide that contracts concluded under the agreement must follow [European] Community rules on public contracts.”

Disagreements over national shares of the project have long bedeviled Galileo and were the proximate cause for the collapse of the consortium negotiating for the concession. During a protracted process from 2002 to 2004, the Galileo Joint Undertaking (GJU), the entity charged with negotiating a concession agreement, encouraged competing industry teams to combine in a single consortium.

The final configuration of companies seeking the Galileo contract included Franco-German EADS, the French Thales Group, UK-based Inmarsat, Italy’s Finmeccanica, Spain’s AENA and Hispasat, and TeleOp, a German group that included an Deutsche Telekom T-Systems, an EADS German subsidiary, DLR, and the Bavarian business and trade bank LfA Förderbank Bayern.

Some observers have blamed the preoccupation with national shares as leading to the overbuilding of the EGNOS with arguably redundant ground facilities scattered across Europe.

In July, European news reports mentioned a new share agreement among top executives at Thales, EADS, and Finmeccanica for work on Galileo. That probably reflects preparation on the part of the industrial stakeholders to develop a common foundation for conversations with the EC and ESA.

In its October 2 statement, the council appeared to address those objections by noting that it “looks forward to a balanced participation of all Member States during the different phases of the project while taking maximum benefit of open competition. . . .”

For ESA, A New Role

The EC’s proposal would create a somewhat novel role for ESA, which has traditionally overseen scientific research and governmental programs in space, such as remote sensing and interplanetary exploration. Galileo, in contrast, will be a commercial system widely used by the civil community as well as commercial enterprises.

ESA has co-funded and co-managed the initial stages of Europe’s GNSS program, whenfocused more on technology demonstrations and proof of concept. It is overseeing the in-orbit validation (IOV) phase of the Galileo program, which includes a €1 billion contract let to European Satellite Navigation Industries (formerly Galileo Industries, a consortium of large European aerospace companies) to build four IOV satellites.

ESA also is responsible for design and implementation of the EGNOS, which will be integrated into Galileo in a few years. The EC proposal would hasten completion of EGNOS in 2008.

In recent years, the EU and ESA have signed a series of high-level agreements, including the first comprehensive European Space Policy, to foster increased cooperation. And earlier this year, the GSA and ESA signed an agreement designed to improve the working relationship on EGNOS.

However, ESA’s record on managing the Galileo-related contracts has been mixed. Earlier this year, the agency acknowledged a growing chorus of complaints from subcontractors, including many small and medium-sized enterprises (SMEs), which said they were being paid late by ESNI or not at all.

And some observers have questioned how well ESA can make the transition from scientific research to a commercial mode of operation.

ESA officials have indicated that they believe it makes no sense to put the IOV spacecraft into orbit until a plan and timeline for launch of Galileo’s remaining 26 satellites has been worked out.

Who’s in Charge?

Aside from the new deployment model and financing, the third area of substantive change proposed by the EC has to do with governance — who makes the decisions and manages the program. A new European GNSS Program Committee would be established to set overall GNSS policy that guided the EC’s efforts, but the EC Directorate-General of Energy and Transport, headed by Ruete, would be firmly in charge of program management.

“The text [of the amended regulation] proposes to improve the public governance of the [Galileo and EGNOS] programmes . . . by granting the Commission a leading role and the responsibility for the implementation of the programmes,” the EC writes in an annex to the amending document. That would necessarily alter the balance between the EC and the GSA.

While still pursuing the PPP approach, the European Council established the GSA under a July 2004 regulation, making it a “community” agency with an administrative board selected by the EU states. GSA staffing now numbers about 50, including nearly 30 persons in the technical department led by Hermann Ebner.

The agency’s existing brief anticipated its signing and supervision of the concession contract, including deployment and operation of the Galileo system — hence the heavy weighting to technical staff. Other responsibilities included market development, security matters (including policies and procedures for implementing the publicly regulated service or PRS), IP licensing, certification, and so forth.

Without a concession to oversee, the GSA would have a differently weighted set of responsibilities under the EC proposal and a markedly less prominent role. “[E]nding the PPP concession negotiations has caused a legal vacuum on the role of the GSA that . . . was based entirely on the putting into place of a concession holder,” the EC communication notes. Indeed, the EC clearly seeks to bring GSA under its jurisdiction.

“As the institution that is directly accountable to Council and Parliament, the European Commission needs to have overall programme management responsibility,” the EC’s communication states.

“The Commission considers that it is essential to have a single Programme Manager on the side of the public sector that is accountable for the entire Galileo programme, that has management and/or contractual control over all the subordinate implementation levels, that has access to both financial resources and to the political authorities, and that can provide the necessary arbitrage between all elements of the programme.”

The proposal calls for a larger (approximately 30 persons) and higher-level Galileo program office, led by a director, within the Directorate-General for Energy and Transport. A current Satellite Navigation System (Galileo), Intelligent Transport unit headed by Paul Verhoef has 14 personnel allocated. Under the EC plan, 21 more positions would be added.

The EC proposal would bring the GSA under its jurisdiction, strengthening some roles, particularly in market development. It would also act as an advisor to the EC and assist in program management.

“A split responsibility with different reporting and accountability lines will cause fractures in the programme and have structural, negative impacts,” the communication argues.

However, GSA Executive Director Pedro Pedreira, whose organization would be subsumed under the EC if the council and Parliament accepts the new plan, argues that just such a separation of powers is needed.

“The commission claims political responsibility for the program,” Pedreira told Inside GNSS. “That’s always been the case, and it’s fully recognized by the member states. But does it also retain executive responsibility for the program? Here we should be very careful.

“We need to separate the political management from executive management. If they [the EC staff] are an interested party to the process, how can they be an arbiter of that process?

On the hand, Pedreira points out, the aim and mission of the GSA was to manage programs. “There is no structural limitation in the GSA to continuing to cover executive management of the program,” even without the PPP model. “And the technical competency to manage deployment already exists in the GSA.”

In fact, some European observers have questioned whether the EC’s Galileo organization, even with the additional staff and Ruete’s personal investment in the project, would have the technical competence to act as the Galileo program director.

Pedreira concurs. “I think the commission is underestimating the capacity they need to manage ESA,” he said, suggesting that the council did not need to rush a decision on governance and could wait until after the financial and deployment issues were resolved.

“Getting the financing in place will take a long time,” he said. “We have plenty of time to get the management issues right.”