In a recent GNSS IC Vendor report, technology market intelligence provider ABI Research says that Thalwil, Switzerland–based u-blox has joined Qualcomm and Broadcom, as the world’s leading suppliers of GNSS integrated circuits (ICs), edging out Taiwan’s MediaTek.

In a recent GNSS IC Vendor report, technology market intelligence provider ABI Research says that Thalwil, Switzerland–based u-blox has joined Qualcomm and Broadcom, as the world’s leading suppliers of GNSS integrated circuits (ICs), edging out Taiwan’s MediaTek.

Unchanged for the past three years, the market’s two top IC vendors remain Qualcomm and Broadcom, soon to be acquired by Avago. Beyond just GNSS, both companies also offer comprehensive location technology platforms in HULA (Broadcom) and Izat (Qualcomm), which will enable smartphone OEMs to begin offering ubiquitous location in 2016. Qualcomm’s work on LED/VLC and LTE Direct illustrates the gap that now exists between it and pure-play GNSS IC vendors, according to ABI Research.

u-blox, a well-established GNSS IC company, has shown continuous growth each year by implementing innovative new technologies and making clever acquisitions, culminating in its first-ever third-place ranking, says ABI Research. The company continues to lead the way in its core markets, while also expanding into the emerging Internet of Things (IoT) space.

The report suggests that the GNSS market is now slowly shifting in new directions. While the smartphone market continues to grow, new opportunities are also emerging in automotive, insurance, wearables, unmanned aerial vehicles (UAVs), and the IoT.

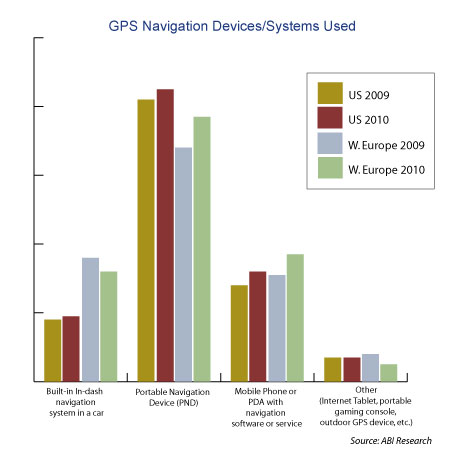

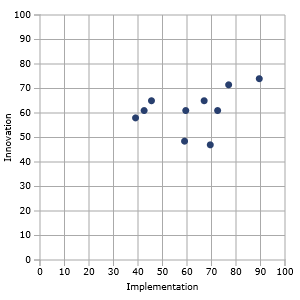

Overall, the GNSS market is forecast to continue to grow strongly, with ubiquitous location and market-specific IC design as key differentiators. In its latest competitive analysis, ABI Research evaluates a variety of innovation and implementation parameters to determine emerging competitive threats and technologies, the companies best positioned for success, and those in danger of losing out.

"The big surprise this year has been MediaTek dropping to fourth place," says Patrick Connolly, principal analyst at ABI Research. "This is primarily due to a lack of innovation, new GNSS, or indoor location products. However, this did not affect its IC market share, or its ability to win an important GNSS IC win with Fitbit in wearables. MediaTek has a history of delivering when its customers need new innovation. As a result, ABI Research expects new product announcements from the company in 2016, especially around indoor location."

Ranking fifth, STMicroelectronics is seeing customers migrate to its new TESEO III platform. Its modular, high performance approach should also enable it to move beyond its traditional markets of automotive and recreational/fitness, especially as it has begun to leverage the company’s expertise in sensor fusion, ABI Research predicts.

As new opportunities for GNSS continue to develop in markets such as wearables, IoT, personal tracking and UAVs, a number of new or emerging companies will appear in the marketplace. ABI’s analysis points to the Chinese regional market as one such area that has potential to demonstrate strong growth trends in future years.

"There’s a big opportunity for emerging Chinese start-ups, such as CEC Huada, to meet new, indigenous, market demand over the next 10 years, while also working their way toward becoming major international competitors," says Connolly. "Additionally, Galileo Satellite Navigation, an emerging company focused in software GPS, is reporting impressive results in trials. As consumer electronics start supporting software GPS, it will be interesting to watch whether or not it can achieve volume shipments in 2016."

These findings are part of ABI Research’s Location Devices Service, which includes research reports, market data, insights and competitive assessments.