Navigation technologies appear to be losing their charm among new car buyers in the United States.

Twenty years after Detroit introduced the first in-vehicle car navigation systems, employing GPS and digital map technology, collision avoidance appears to be the common theme among the most popular automotive technologies, according to a new J.D. Power study released last Wednesday (April 22, 2015).

Navigation technologies appear to be losing their charm among new car buyers in the United States.

Twenty years after Detroit introduced the first in-vehicle car navigation systems, employing GPS and digital map technology, collision avoidance appears to be the common theme among the most popular automotive technologies, according to a new J.D. Power study released last Wednesday (April 22, 2015).

In the inaugural U.S. Tech Choice Study, a total of 59 advanced vehicle features were examined across six major categories: entertainment and connectivity; comfort and convenience; collision protection; driving assistance; navigation; and energy efficiency.

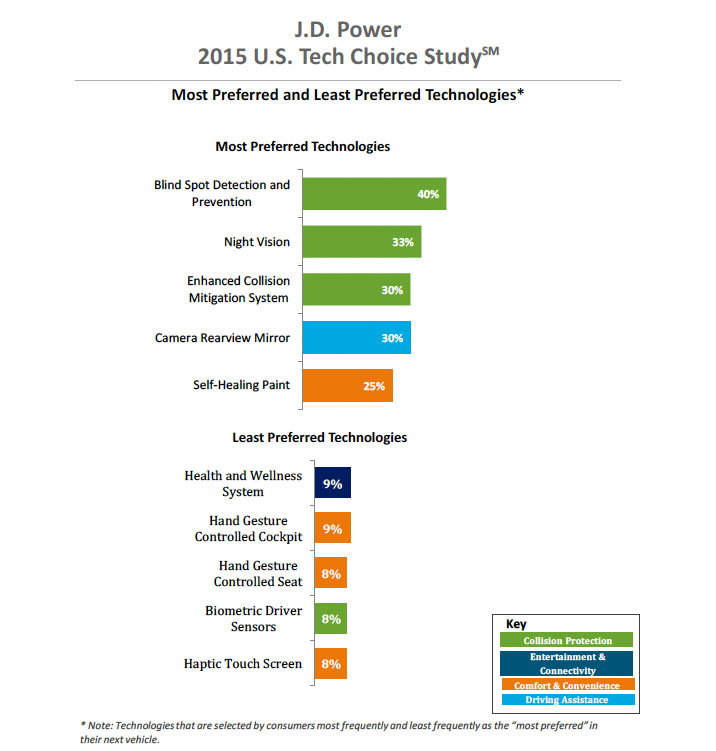

Navigation-based applications — such as route guidance — are ranked much lower than those related to collision mitigation: blind-spot detection and prevention systems, night vision, and enhanced collision-mitigation systems.

The J.D. Power 2015 U.S. Tech Choice Study uses advanced statistical methodologies to measure preference for and perceived value of future and emerging technologies. The study was fielded in January through March 2015 and is based on an online survey of more than 5,300 consumers who purchased or leased a new vehicle in the past five years.

Technologies in the navigation category have low preference across all vehicle price segments, the study showed, perhaps reflecting a common complaint that has surfaced in recent studies by the company that "navigation system difficult to use" is among the most common type of problems drivers experience in the first 90 days of vehicle ownership, according to a different 2014 J.D. Power study.

Growth in smartphone-based telematics location-based service (LBS) apps may also be contributing to the decline in interest in OEM navigation systems. Mobile phone purchase cycles — and associated technology development — are much shorter than automotive electronics system design, lowering the risks and costs of innovation while increasing flexibility and timeliness of new features.

Mobile phone/vehicle connectivity, however, remains a subject of low interest to consumers. According to the study, Apple CarPlay and Google Android Auto connectivity technologies have the lowest preference scores across all generations. Kolodge noted that "lukewarm interest in these technologies that connect your phone to your vehicle coupled with consumer loyalty to their phone poses a unique challenge for automakers, which could be remedied by knowing their customers’ phone preferences."

In general, technologies that reduce the overall burden of driving and enhance vehicle safety received the most consumer interest, according to the study. (See accompanying figure.) This indicates that vehicle owners are more receptive to the idea of the vehicle taking over critical driving functions such as braking and steering, according to J. D. Power. Full self-driving automation technology, part of the collision protection category, is designed to perform all safety-critical driving functions and monitor roadway conditions.

"There is a tremendous interest in collision-protection technologies across all generations, which creates opportunities across the market," said Kristin Kolodge, executive director of driver interaction & HMI research at J.D. Power.

A key finding of the study is that the younger generations (Gen Y and Gen X) have substantially higher preference for the technology than the older generations (Boomer and Pre-Boomer). The Pre-Boomer generation, in contrast, has a greater preference for lower levels of automation, such as traffic-jam assist. J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946–1964); Gen X (1965–1976); and Gen Y (1977–1994).

Perhaps not surprisingly, younger customers are more willing to spend more on technology. The study shows that Gen Y consumers will spend an average of $3,703 on technology for their next vehicle. Gen X is willing to spend $3,007; Boomers, $2,416; and Pre-Boomers, only $2,067.

Navigation technology, although now of less interest to car buyers, hasn’t fallen to the bottom of the heap. That position is led by advanced sensor technologies, such as hand-gesture-controlled seats, biometric driver sensors or haptic touch screens.