Two companies angling to provide the government with cutting-edge, GPS-based weather data may get a boost this fall if a bill aiming to improve forecasting wins U.S. House approval.

The companies, Bethesda, Md.-based Planet IQ and GeoOptics, Inc., of Pasadena, California, hope to use GPS radio occultation or GPS-OR to provide the National Oceanic and Atmospheric Administration (NOAA) and the Department of Defense with weather data.

Two companies angling to provide the government with cutting-edge, GPS-based weather data may get a boost this fall if a bill aiming to improve forecasting wins U.S. House approval.

The companies, Bethesda, Md.-based Planet IQ and GeoOptics, Inc., of Pasadena, California, hope to use GPS radio occultation or GPS-OR to provide the National Oceanic and Atmospheric Administration (NOAA) and the Department of Defense with weather data.

The Weather Forecasting Improvement Act (H.R. 2413) has a provision making it clear that the nation’s weather agency is allowed to purchase commercial satellite data and is not constrained by laws prohibiting the commercialization of the government’s weather satellites. It also directs the agency to come back within six months with an assessment of “the range of commercial opportunities” and a plan “for procuring data from these non-governmental sources.”

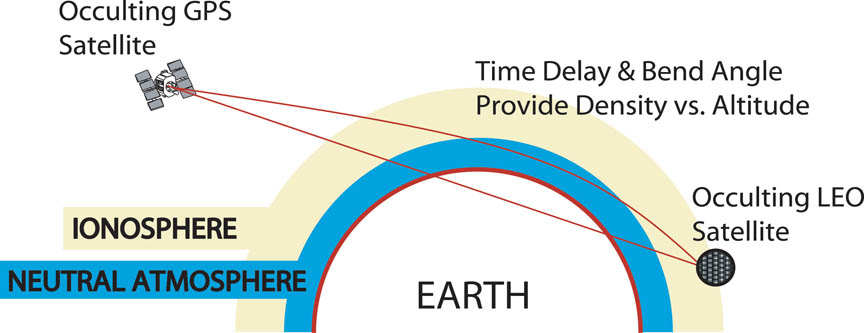

GPS-OR uses low Earth orbiting (LEO) satellites to receive signals from GPS satellites located just out of sight over the horizon. The GPS signals bend a bit as they skim through the atmosphere — a deflection that is a function of the density of the atmosphere. The time it takes for the signal to travel the now longer path around the curve of the planet can be used to calculate atmospheric properties, such as temperature, pressure, humidity and electron density.

A constellation of satellites could provide very accurate data on these factors, which are key elements in forecasting the weather day to day. They can also be used to forecast “space weather,” the solar flares and geomagnetic storms that impact the operations of a wide range of infrastructure, including utilities and the communications satellites that carry phone calls and the latest championship game.

Although the ongoing budget fight and the possibility of a conflict in Syria could upend plans, the House Science Space and Technology Committee currently is expected to vote on the bill before the end of September.

A ‘Yes” vote could brighten the fundraising prospects for the companies, which are both in the process of finding backers to help them build satellite networks that ultimately could comprise dozens of spacecraft. Although both companies plan to begin operations with smaller “starter” constellations, their satellites could boost the number of soundings of the atmosphere from a couple hundred or couple thousand to tens of thousands, said John Kirchner, GeoOptics’ president and chief operating officer.

The real challenge, said officials from both firms, is getting NOAA to fully consider buying weather data and not always rely on its own satellites.

Anne Miglarese, PlanetIQ’s president and chief operating officer worked for NOAA for a decade and on NOAA-funded state programs for eight years and then had NOAA as a customer for another decade. “I’m very familiar with some of NOAA’s data buy contracts,” she told Inside GNSS.

Although the agency does buy commercial satellite imagery, she said, its purchases of weather data are limited. “In the weather enterprise I believe they buy lightning data and they may buy some mesonet data — but they do not at present buy any data from the satellites.”

“By historical experience there seems to been a fairly limited and not particularly proactive use of, or seeking out of, commercial solutions on the part of NOAA and (NOAA’s) National Environmental Satellite, Data, and Information Service in the past,” said Jon Kirchner, president and chief operating officer for GeoOptics. “What we are seeking — for all commercial potential service providers of data — is a playing field such that NOAA looks at (commercial providers) as not just a viable but as a much less expensive, reliable source of data in contrast to the big large satellite procurement that it’s tended to wed itself to over the last many decades.”

Kirchner pointed out that GPS-OR can provide “rock star” quality data and has already proven by the Constellation Observing System for Meteorology, Ionosphere, and Climate (COSMIC-1) satellite. Louis Uccellini, director of the National Weather Service, credited COSMIC-1 data for a 9 percent reduction in error in the European forecast model, according to a presentation chart and article posted June 9 by the Houston Chronicle.

GPS-OR data will also be particularly useful to climate researchers, said Kirchner, because it does not “drift” over time in terms of accuracy and readability. Both firms told Inside GNSS they plan to make the historical data available to researchers free of charge after providing it to clients for real-time needs. The data from PlanetIQ could be available to scientists in as little as 48 hours, said Miglarese.

Potential Budgetary Benefit, Too

In addition to potentially reducing cost and providing more and better data the commercial providers could potentially help NOAA bridge a critical program gap.

Some of NOAA’s weather data satellites are nearing the end of their design life and the agency does not yet have solid plans to replace them, according to the Government Accountability Office (GAO). The agency listed the potential gap in weather data in its annual 2013 High Risk Report this spring and estimated the gap in data could last “17 to 53 months or more, depending on how long the current satellite lasts and any delays in launching or operating the new one.”

“I think it really is a necessity that there be, hopefully, more diverse sources of weather satellite or weather-related data,” said Scott Pace, the director of the Space Policy Institute at George Washington University’s Elliott School of International Affairs. “If that comes from the commercial sector and there are data buys to do that, I think that would be great. We’ve done similar things already in commercial remote sensing, which has supported government interests. If that can be done in weather satellite data, if there is a business case there, I think that would be very helpful.”

The Weather Forecasting Improvement Act aims to nudge federal officials into buying privately provided data. Current law prohibits the government from “any effort to lease, sell, or transfer to the private sector, or commercialize, any portion of the weather satellite systems operated by the Department of Commerce or any successor agency.”

Though that does not necessarily mean that NOAA cannot already buy commercial data. Section 9 of the bill states clearly that the commercializing prohibition shall not extend to “the purchase of weather data through contracts with commercial providers.”

In fact, the agency has “developed a close working relationship with the U.S. commercial weather sector,” said Kathryn Sullivan, acting undersecretary of commerce for oceans and atmosphere and acting NOAA administrator. Speaking before the House Subcommittee on Environment, on June 26, she said, ”NOAA has purchased data from the commercial sector to fulfill a number of specific requirements” giving synthetic aperture radar data as an example.

“NOAA is assessing the possibility of expanding data purchases from commercial sources and is closely monitoring ongoing international demonstration projects in this area,” Sullivan said, though she noted that any data would need to be supplied “within NOAA’s operational construct.”

The real challenge for the companies, said Miglarese, is that NOAA has always provided its own data and is strongly inclined to continue to do so.

“I think that is the biggest issue. I think a long pole in the tent here is not the business case or any technology issue. The issue is a cultural, corporate behavioral — how they see themselves,” she said.

The challenge for the bill, however, is quite different. No companion bill has been filed in the Senate, and other provisions in the measure are widely seen as an effort to divert resources from climate research. This makes it less likely that the U.S. Senate, which is controlled by the Democrats, will pass — or even consider — such the measure.

Even so, staff on both sides of the aisle are working on the bill and amendments are being crafted, said experts following the legislation. Given the budget crunch and the threat of a period without critical weather data it is possible that a modified version of the measure could advance before the session is over.