After three years in Chapter 11, the company whose planned wireless broadband system threatened to overload GPS receivers across the United States is preparing to emerge from bankruptcy.

After three years in Chapter 11, the company whose planned wireless broadband system threatened to overload GPS receivers across the United States is preparing to emerge from bankruptcy.

Although the passage of time has done little to change the issues between Virginia-based LightSquared and the GPS community, although the context in which some of those issues will be decided has decidedly shifted. The Senate is now under Republican control, federal agencies are counting pennies, the Federal Communications Commission (FCC) has a new chairman, the law governing the FCC is being rewritten, and the value of auctioned spectrum has skyrocketed.

Perhaps most importantly, the heated fight between the company and GPS organizations in 2011 instilled a far deeper and wider understanding of satellite navigation. Decision makers who were unaware of the ubiquitous use of GPS — and, more broadly, GNSS — signals are now far more familiar with its deep integration into the nation’s economy and critical infrastructure. This awareness is reinforced daily by fresh worries over cybersecurity, signal jamming and satellite vulnerabilities.

Court: Thumbs Up

On March 26 Bankruptcy Judge Shelley C. Chapman, after considering a years-long string of proposals, approved an exit plan for the firm that will largely put control of LightSquared in the hands of its investors and pay $1.5 billion to major creditor and broadband rival Charlie Ergen, president, CEO and of chairman of the board of Dish Network. The Harbinger hedge fund, the primary backer of LightSquared, and its CEO Phil Falcone are to maintain a minority role.

It is now unclear, however, if the plan will stand.

Bloomberg reported on May 12 that Ergen had filed a challenge to the plan in court, alleging the “bankruptcy plan gives hedge funds that invested in the broadband company a leg up while blocking telecommunications firms from competing with it.”

Even if the exit plan withstands another challenge, the court’s approval was always just the first of two steps involved in emerging from bankruptcy. Light- Squared must also convince the FCC to transfer its spectrum licenses to the reconstituted company, called, appropriately enough, New LightSquared.

The transfer request, which will be published for public comment, was submitted to the FCC on April 6. As of mid- May, however, it had not appeared in the Federal Register.

Wanna Trade?

In the meantime LightSquared is waiting on a different FCC decision — this one on its proposal to modify its spectrum licenses.

The company had originally sought to repurpose frequencies allocated for relatively low-powered satellite signals to instead support a network of some 40,000 broadband ground stations. That broadband capacity was to be sold wholesale, potentially fueling an entirely new level of competition — an approach that appeared at the time to inspire strong FCC support.

LightSquared’s plan, which came fully to light late in 2010, also dovetailed neatly with a pledge made by the White House. The Obama Administration, heading into a mid-term election with a damaged economy, had promised to find 500 megahertz of spectrum for the ballooning, and hopefully job-rich, broadband sector.

The project ran aground, however, after tests confirmed that the Light- Squared signals would overload the vast majority of GPS receivers. The FCC put the project on indefinite hold in February 2012 and the firm filed for protection from its creditors three months later.

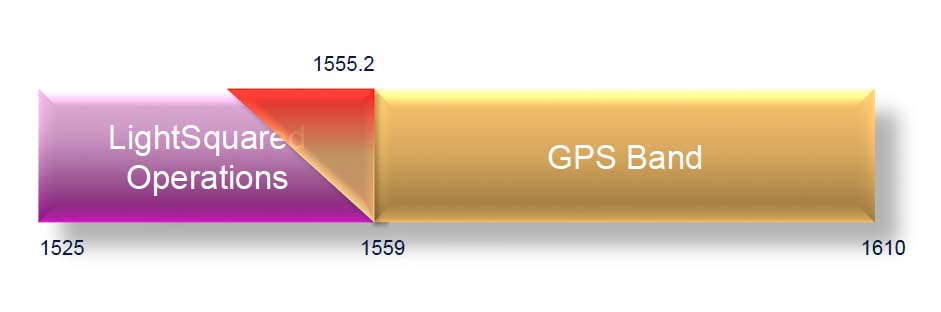

LightSquared proposed a spectrum swap in September 2012 to ameliorate some of the interference. The firm currently has licenses for two 10-megahertz bands of spectrum running from 1526 to 1536 MHz and 1545.2 to 1555.2 MHz for downlink and two 10-megahertz bands at 1627.5 to 1637.5 MHz and 1646.7 to 1656.7 MHz for uplink.

The company has offered to forego the use of the most problematic 1545.2 to 1555.2 MHz band, which is the one closest to the GPS frequencies. It would also refrain — for an unspecified amount of time — from using the other downlink band to allow GPS users to transition. In exchange LightSquared is asking to be allowed to share a five-megahertz band (1675 to 1680 MHz) used by the National Oceanic and Atmospheric Administration. The firm happens to have rights to use an adjacent five megahertz band, so it would have 10-megahertz block of frequencies to balance out its set.

Money Hits the Airwaves

The FCC has yet to decide but the practicalities of making a straight swap are murky given the current budget climate and a sudden, recent surge in spectrum values. The sequestration limits that upended federal spending in 2013 had not been implemented when the company first proposed the swap in 2012. Now, any such deal is likely to face stiffer headwinds.

The challenge was underscored in the president’s fiscal year 2016 budget, which is currently under consideration in Congress. Even though LightSquared’s proposal has been on the table for several years, the White House factored auctioning the band into its budget request, plugging $230 million in anticipated revenue into the FCC’s allocation.

And that $230 million estimate is very likely to be low.

Auction 97 for “advanced wireless services”, a spectrum auction that ended this January, underscored just how valuable every megahertz has become. The sale of paired frequency blocks, including frequencies from 1755 to 1770 MHz, drew 70 qualified bidders, and raised $41.3 billion in net bids — blowing past the preset reserve of $10 billion and more than doubling the $20 billion experts had expected.

Even if the FCC elected to forgo an auction and sell the spectrum directly to LightSquared, the price would have to be far higher than $230 million to prevent other hopeful owners with broadband aspirations from raising a stink.

“The reality is that spectrum is going to be auctioned,” said Tim Farrar of Telecom, Media and Finance Associates, Inc., an expert in satellite communications and wireless spectrum.

“When you look at what spectrum has sold for this year, it’s hard to imagine that it wouldn’t be seen as a giveaway, if they were to give that spectrum or sell that spectrum to LightSquared for $200 million,” said Farrar. “It ought to be worth at least $1 billion.”

The good news for LightSquared is that high spectrum prices could give the company some fiscal elbowroom. A valuation prepared by the investment bank Moelis in 2014, completed before Auction 97, put the value of LightSquared’s two uplink bands and the potential NOAA frequencies at $4.8 to $7.2 billion in October 2014 dollars. At the point Light- Squared can use the less troublesome of the two original downlink bands, it will add between $881 million and $1.22 billion to the company’s valuation.

The recent auction results now suggest much higher numbers and those suggested by Moelis and go a long way toward explaining the abiding interest in LightSquared’s spectrum, interference issues and all.

The numbers also put more pressure on the GPS community, which is not convinced that the latest LightSquared plan will work compatibly on a technical basis with GNSS receivers.

Cautious Comments

The organizations that posted feedback during the FCC comment period on LightSquared’s swap proposal generally expressed their support for finding more bandwidth for broadband. They were also generally deeply cautious about the proposal, particularly with regard to potential problems from having a large number of handsets operating in the two uplink bands.

The Department of Transportation (DoT), which represents non-military users of the GPS system in the National Executive Committee for Space-Based Positioning, Navigation, and Timing (PNT), underscored the worries about the handsets.

In a letter submitted through the National Telecommunications and Information Administration (NTIA), DoT noted a lack of data on the proposed handsets and assumptions about how many handsets there would be. The impact of the handsets on aviation needed to be more full assessed, the agency said, including doing analyses with different airframes and looking at handsets operating at maximum power as opposed to average power.

DoT also argued for a closer examination of assumptions made about GPS receiver antennas and an analysis of the potential adverse effects that Light- Squared user equipment on the ground or at the gate could have on aircraft either in flight and/or on the ground.

“In light of these concerns,” the letter said, “the Department questions whether the Commission has the necessary and sufficient information before it to approve the handset proposal at issue in the Public Notice. Again, to the Department’s knowledge, there has not been any robust interagency effort to examine or test LightSquared’s proposal, to probe the underlying assumptions or to consider feasible alternatives. Furthermore, at least with respect to potential GPS interference, the Department notes that this is not solely a government concern, but one in which a variety of individuals and organizations, including many in the private sector, have a stake.”

A number of those who submitted comments asked that the matter be evaluated through a full rulemaking process. An ad hoc approach was “precisely what has impeded LightSquared from providing its initially proposed service in the first instance,” wrote the GPS Innovation Alliance (GPSIA).

“Instead,” GPSIA suggested, “these issues should be considered in a broader spectrum planning process,” GPSIA suggested, “in the context of a transparent public notice-and-comment rulemaking proceeding in which established spectrum protection criteria and all relevant public policy issues can be considered to determine the parameters in which the spectrum can be safely used.”

Capitol Hill

As it happens a bill now before Congress would emphasize just that approach. The Federal Communications Commission Process Reform Act of 2015 seeks to make the FCC process more transparent. Among its many provisions are minimum comment periods — something that could have eased the initial tension between LightSquared and the GPS community when the company’s proposal was first published in 2010.

The bill (S. 421) has already been submitted to the Senate, and the House was scheduled to debate a draft of the bill, which appears to be the same as the Senate measure, as this publication was going to press.

One of the bill’s proponents is Greg Walden (R-Oregon), one of two lawmakers leading an effort to rewrite the Telecommunications Act of 1934, which governs the FCC. Walden is chairman of the Subcommittee on Communications and Technology under the Committee on Energy and Commerce and his involvement improves the chances the bill will either be passed or incorporated into the larger rewrite of the Telecom Act.

Changes in the Telecommunications Act won’t necessarily affect Light- Squared, but changes over in the Senate might. Sen. Chuck Grassley (R-Iowa), who was tapped to head the Judiciary Committee when Republicans took control of the chamber. He was one of 33 senators who sent a letter to the FCC asking it to rescind a conditional waiver granted to LightSquared early in 2011. He also conducted a high profile investigation into whether the White House was playing favorites with the firm’s proposal.

That is not to say that New Light- Squared will be approaching Washington unarmed. LightSquared spent $1.14 million on lobbying last year and $160,000 during the first quarter of 2015, according to lobbying disclosure forms.

New LightSquared’s incoming board also has a couple of serious players. The chairman, according to court records, will be Ivan Seidenberg, a former chairman and CEO of Verizon Communications Inc. Joining him will be Reed Hunt, who was FCC chairman from 1993 to 1997.

Congress and the FCC are not, however, where the major action is at this point. The real sparring has been taking place at a series of workshops and standards meetings.

ABC Skirmishes

The Adjacent-Band Compatibly Assessment, now being conducted by the DoT’s John A. Volpe National Transportation Systems Center in Cambridge, Massachusetts, aims to head off future interference issues by letting companies know in advance the power limits by which they need to abide in order to avoid interfering with GPS.

DoT will first determine masks, that is, a set of power limits by frequency, for the bands near the GPS L1 signal. In thesecond phase it will do the same for frequencies near new GPS signals such as L5 and those near bands being used by other satellite navigation constellations.

“Step 1 is basically protecting all the existing receivers that are used for civilian applications and then Step 2 is looking into the future at what receivers might evolve into,” said Chris Hegarty, co-chairman of RTCA Special Committee 159 which deals with GPS issues, in a 2013 interview.

RTCA Inc. is a nonprofit association that coordinates volunteers developing consensus-based technical standards for the Federal Aviation Administration (FAA). It became involved when aviation officials asked for expert advice on six technical questions for the study. The FAA is working on the portion of the assessment that deals with certified aviation receivers; Volpe will handle the rest.

The group, with the exception of LightSquared, reached consensus in March. Given the time constraints and unlikelihood of agreement, LightSquared was invited to submit a minority report with its views to the FAA along with the committee’s results. LightSquared’s report suggested a significant number of technical changes to the overall study as well as the FAA portion, including not using a six-decibel safety margin in all cases.

“The 6 dB safety margin should be applied only to use cases where the aircraft is in motion,” the company wrote, “and reliant on GPS for navigation or other critical flight functions.”

A summary of the consensus view said the concern about using a six-decibel margin for ground operations had been raised with FAA, which responded that using six decibels was “applicable due to flight operations safety and regularity considerations” — that is, not just safe operations but also efficient operations. Regularity is a concept embedded in the International Civil Aviation Organization Safety Oversight Manual.

The six-decibel disagreement, explained Farrar, is about the size of the safety margin.

“One of LightSquared’s arguments has always been that no one will notice anything much,” said Farrar. “They [aviation officials] can say, ‘OK. This is what we need to guarantee everything will be okay,’ and LightSquared will say, ‘Well, that is overly conservative and nobody is going to notice if we go a bit over that.’”

LightSquared also wrote that it agreed with the FAA’s approach of using “change in position error as its key measurement to certify compliance with its GPS standards, underscoring the fundamental role of this measure in determining whether harmful interference is present.”

Volpe, it noted, chose to use change in the noise floor as its key performance indicator (KPI) for the task of defining the adjacent band mask.

“This is a critical distinction,” Light- Squared said in its dissent. “A position error analysis appropriately focuses on whether any kind of interference would actually result in a GPS receiver reporting a material change in position perceptible to the pilot or avionics system receiving the data (as defined in the FAA/ RTCA standards), and thus whether the interference actually qualifies as harmful interference. A 1 dB increase in the noise floor, on the other hand, has never been shown to correlate with any kind of predictable impact on the data reported by GPS receivers.”

The FAA, however, does not use actual position error by itself as its key metric, Hegarty recently told Inside GNSS.

“In the presence of interference at the mask levels, all the performance requirements must be met for the receiver,” he explained. “Position accuracy is just one of many performance requirements that the equipment needs to satisfactorily achieve in the presence of the specified maximum levels of interference.”

Chasing GPS Receiver Standards

LightSquared also recommended that the FAA’s approach should become the model for the rest of the assessment study — suggesting that, as for certified aviation receivers, receiver standards would be a good thing.

“FAA’s analysis,” wrote LightSquared, “and thus (RTCA’s Working Group-6’s) input to the FAA, assumes standards for GPS receivers that RTCA and the FAA had previously set for the function of certified GPS receivers — forward-looking minimum performance standards, as expressed in required receiver masks, that all GPS devices certified for use in aviation applications must meet.”

“While not specifically open for discussion in WG-6’s work,” the company added couple of pages later, “it is nevertheless important as a part of the overall DoT Study process to emphasize that RTCA’s recommendations, and FAA’s eventual analysis, are based upon standards for GPS receivers that RTCA and the FAA had previously set for the function of certified GPS receivers.”

“By contrast,” LightSquared continued, “the Volpe Center’s current plan is to establish a mask retroactively, and solely to limit power in bands of commercial spectrum adjacent to GPS based on the poorest performing GPS devices. The Volpe Center is not intending to establish (or recommend to the regulators of commercial spectrum) a set of minimum, forward-looking performance standards for the GPS devices it is studying. Rather, it plans to develop its mask based on a backwards-looking approach that seeks to protect all receivers, regardless of relevance or criticality of use case.

“Thus, while the FAA/RTCA approach can reasonably be shown to have the effect of encouraging receivers to be more resilient and safer (particularly as such standards are updated over time), the Volpe Center’s approach inevitably drives to protecting the worst performing devices and does not encourage development of more resilient receivers.”

It would not be the first time that receiver standards have been suggested.

In 2012 then-FCC Chairman Julius Genachowski, who was widely seen as an advocate for LightSquared, tasked the FCC’s Technological Advisory Council with studying the role of receivers and providing “recommendations on avoiding obstacles posed by receiver performance to making spectrum available for new services,” according to a post by the National Association for Amateur Radio.

The GPS community fiercely opposed standards at the time as a hindrance to innovation and a threat to the future of the millions of GPS receivers already installed and in operation. Now, the idea of receiver standards may have lost energy within the FCC. Tom Wheeler, Genachowski’s replacement as FCC chairman, took a decidedly different tack when addressing a 2014 workshop on protecting GPS.

“Today is about federal and nonfederal leaders coming together to discuss successful industry-driven collaborations and GPS receiver performance. These are not abstract issues,” Wheeler said. “But let me also be specific about what today is not. It is not about FCC-mandated receiver standards. Rather it is about the best way to protect GPS operations in the context of evolving technology and adjacent spectrum activities.”

Redrawing the Battle Lines

Both LightSquared and members the GPS community have stressed their willingness to work toward solutions, although their respective positions to not appear to have gotten much closer. If anything the two sides seem to be girding for battle in ever more distant corners.

Even so, the respective positions of the company and GPS advocates do not appear to have gotten much closer. If anything the two sides seem to be farther apart than ever.

LightSquared, for example, said in a March workshop held by the ABC Assessment team that agreement was not essential. When it comes to decisions on activities in commercial sectors of the spectrum the “FCC has exclusive jurisdiction,” said Geoff Stearn, vice-president for spectrum development at LightSquared.

The “only purpose of any such study,” he said of the ABC Assessment, “is to inform FCC regulatory action.” In fact, the company asserted that “the established process is for agencies to ask the FCC to conduct such studies.”

That assertion set off a furious exchange between the Light- Squared representatives including Stearn, and Don Jansky, a former associate administrator for the NTIA and president of Jansky-Barmat Telecom. Their exchange, in part:

Jansky: The FCC is not the final arbiter of the emissions. There is joint responsibility with NTIA. These agencies and NTIA do not report to FCC. They have a separate regulatory regime. And they have joint responsibility, particularly for the GPS band. So, they are not the final arbiter of what is the regulatory aspect regarding emissions. You should understand that. I don’t think you understand how spectrum management works in the United States.

LightSquared: I don’t want to continue the debate. I understand that that’s the NTIA’s view. The Communications Act invests the responsibility to regulate commercial enterprises, which is LightSquared, with the Federal Communications Commission.

Jansky: That may be for LightSquared, but it isn’t for the United States.

LightSquared: We’re talking about rules that would affect LightSquared.

Jansky: We’re talking about rules that would impact GPS. The next scene in the drama will be played out on a Washington stage. The Adjacent-Band Compatibly Assessment team will hold another workshop there on June 19.

LIGHTSQUARED LAWSUITS LINGER

During the same period that LightSquared was working to emerge from bankruptcy, it and its primary backer, Harbinger Capital Partners, between them sued the federal government, a number of GPS firms and associations as well as Dish Network chairman Charlie Ergen.

Though the case against Ergen and most of the allegations against the business community were dismissed, the lawsuit against the government is still active — well, if you use the word “active” loosely. The only action since the lawsuit was initiated in July 2014 has been seven requests for extensions.

More activity has taken place at the U.S. District Court. The remaining counts against the GPS business community are for negligent misrepresentation and constructive fraud and stem from LightSquared’s accusation that the GPS companies knew about, but failed to disclose in pre-2010 negotiations with LightSquared, their knowledge of and concerns about the “out-of-band reception” of GPS receivers that gathered GNSS spread spectrum signals in the MSS band as well as the GNSS L1 band.

The remaining counts leave the parties — Deere & Company, Garmin International, Inc., Trimble Navigation Limited, and the U.S. GPS Industry Council (USGIC) — open to discovery, Reuters noted in its reporting, which means that LightSquared could “probe the GPS companies’ books and records.” Any ability to obtain business or technical data is potentially significant. LightSquared, for example, has asserted that the ongoing Adjacent-Band Compatibility Assessment should only test top-selling devices.

Discovery, however, is a blade that cuts both ways, pointed out wireless spectrum expert Tim Farrar. If the case continues, LightSquared could find its secrets revealed as well.