Assuming that its deal to acquire ST-Ericsson’s GNSS business closes in August as expected, Intel Corporation will find itself with expanded opportunities — and competitive set — in the mobile location marketplace.

Over the years, Intel has dominated the now-mature, even declining personal computer and server markets, but has found the rapidly growing mobile device environment — including smartphones and tablets —tougher going. Its Atom processor reportedly resides in only 12 percent of the former and 15 percent of the latter.

Assuming that its deal to acquire ST-Ericsson’s GNSS business closes in August as expected, Intel Corporation will find itself with expanded opportunities — and competitive set — in the mobile location marketplace.

Over the years, Intel has dominated the now-mature, even declining personal computer and server markets, but has found the rapidly growing mobile device environment — including smartphones and tablets —tougher going. Its Atom processor reportedly resides in only 12 percent of the former and 15 percent of the latter.

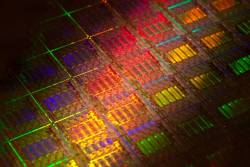

But a long-term powerhouse in the chip business, Santa Clara, California–headquartered Intel brings to the challenge the perspective and resources of a platform provider known for playing a long game strategically. It soon will have an in-house source for a key location technology that the company has, up till now, depended on outside vendors — including u-blox, CSR, Broadcom, and ST-Ericsson — to supply.

ST-Ericsson’s G1960 chip, built with 40-nanometer CMOS technology, provides GPS, GLONASS, Quasi-Zenith Satellite System (Japan’s QZSS), satellite-based augmentation system (SBAS), and assisted-GNSS functionality. A nascent BeiDou capability is reportedly also in the connectivity unit’s technology mix.

Organizationally, the ST-Ericsson business will be merged with the Mobile and Communications Group overseen by corporate vice-president and general manager Hermann Eul. Combined with its 2011 acquisitions of Infineon Technologies’ wireless business (from which Eul joined Intel) and Israeli mobile navigation and location-based services software provider Telmap, Intel is steadily accumulating the technology components for mobile initiatives.

At this year’s Mobile World Congress in February, Telmap announced an agreement to obtain maps and road data from Amsterdam, The Netherlands–based TomTom.

But all this activity doesn’t guarantee success for Intel’s internal technology suppliers, which remain separate from the company’s various platform groups that create the actual products for desktop PC, laptop, phone, tablet, automotive, and other customer categories.

Unquestionably, though, the move to acquire ST-Ericsson does underscore Intel’s recognition that location has become an essential element for its platforms, where GNSS is coupled with WiFi, inertial dead-reckoning, digital maps, and — going forward — emerging location technologies. The ST-Ericsson deal also brings BlueTooth, WiFi, and FM assets.

ST-Ericsson is a 50/50 joint venture launched in 2008 that merged Ericsson Mobile Platforms and ST-NXP Wireless, the latter company having been formed earlier that year when NXP acquired GPS technology supplier GloNav, Inc. ST-Ericsson currently has about 130 employees located in Daventry, England (going back to its Navstar Ltd. origins); Bangalore, India; and Singapore.

All did not go as hoped, however, and the two parent companies announced plans to dissolve the enterprise earlier this year following a steep decline in sales. The company reported an operating loss of $158 million on sales of $256 million in the first quarter of this year.

The GNSS acquisition is probably less expensive than the Telmap deal, reportedly north of $300 million, and certainly less than the $1.4 billion it paid for Infineon’s wireless business. Although Intel itself appears to be waiting until after the deal closes to comment publicly, ST-Ericsson has said that proceeds from the sale, “combined with the avoidance of employee restructuring charges and other related restructuring costs,” will reduce the joint venture’s cash needs by approximately $90 million.

“Today’s transaction validates the leading innovation developed by ST-Ericsson in mobile navigation systems and marks a further important step towards the execution of our shareholders’ decision to exit from ST-Ericsson” said Carlo Ferro, president and CEO of ST-Ericsson when the company announced its impending sale. “I am pleased that this organization will continue to develop leading-edge technologies and delighted that the team found a new home at a leading player in the semiconductor industry.”